Family Loan Agreement Template Free – A Comprehensive Guide for Secure and Effective Agreements

Creating a legally sound Family Loan Agreement is a crucial step in establishing a strong and reliable relationship with a loved one or a trusted individual. It protects both parties involved, outlining expectations, responsibilities, and potential liabilities. A well-drafted agreement can prevent misunderstandings, minimize disputes, and safeguard assets. This guide provides a comprehensive overview of what to include in a Family Loan Agreement, along with essential considerations for its creation. Understanding the nuances of this document is paramount for ensuring a smooth and beneficial partnership. This template offers a solid foundation, but it’s always recommended to consult with a legal professional to tailor the agreement to your specific circumstances. Don’t rely solely on this template; a consultation with an attorney ensures the agreement is legally sound and reflects your unique needs.

Understanding the Importance of a Family Loan Agreement

The need for a Family Loan Agreement goes beyond simply borrowing money. It’s about establishing a framework for managing expectations, defining roles, and addressing potential issues that may arise over time. It’s a proactive measure that demonstrates respect, transparency, and a commitment to responsible financial management. Without a formal agreement, disagreements can escalate quickly, leading to costly legal battles and strained relationships. A clear agreement minimizes the risk of misunderstandings and provides a roadmap for resolving conflicts. Furthermore, it can be invaluable for planning for the future, outlining how assets will be managed and distributed if the relationship ends. The benefits extend beyond the immediate transaction; a well-structured agreement fosters trust and strengthens the bond between family members. It’s an investment in the longevity and stability of the relationship.

Key Components of a Family Loan Agreement

A comprehensive Family Loan Agreement should address several key areas. Let’s break down the essential elements:

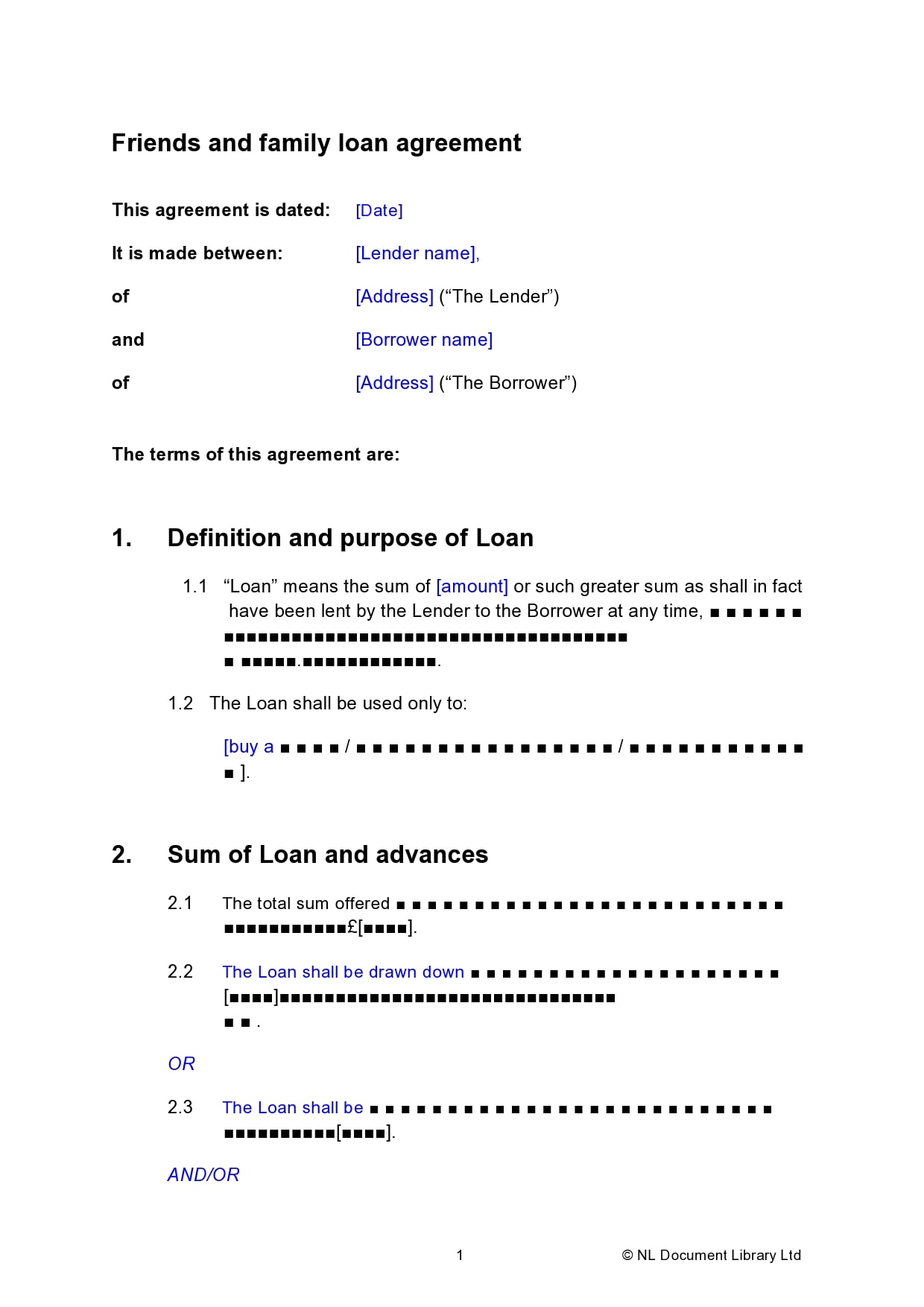

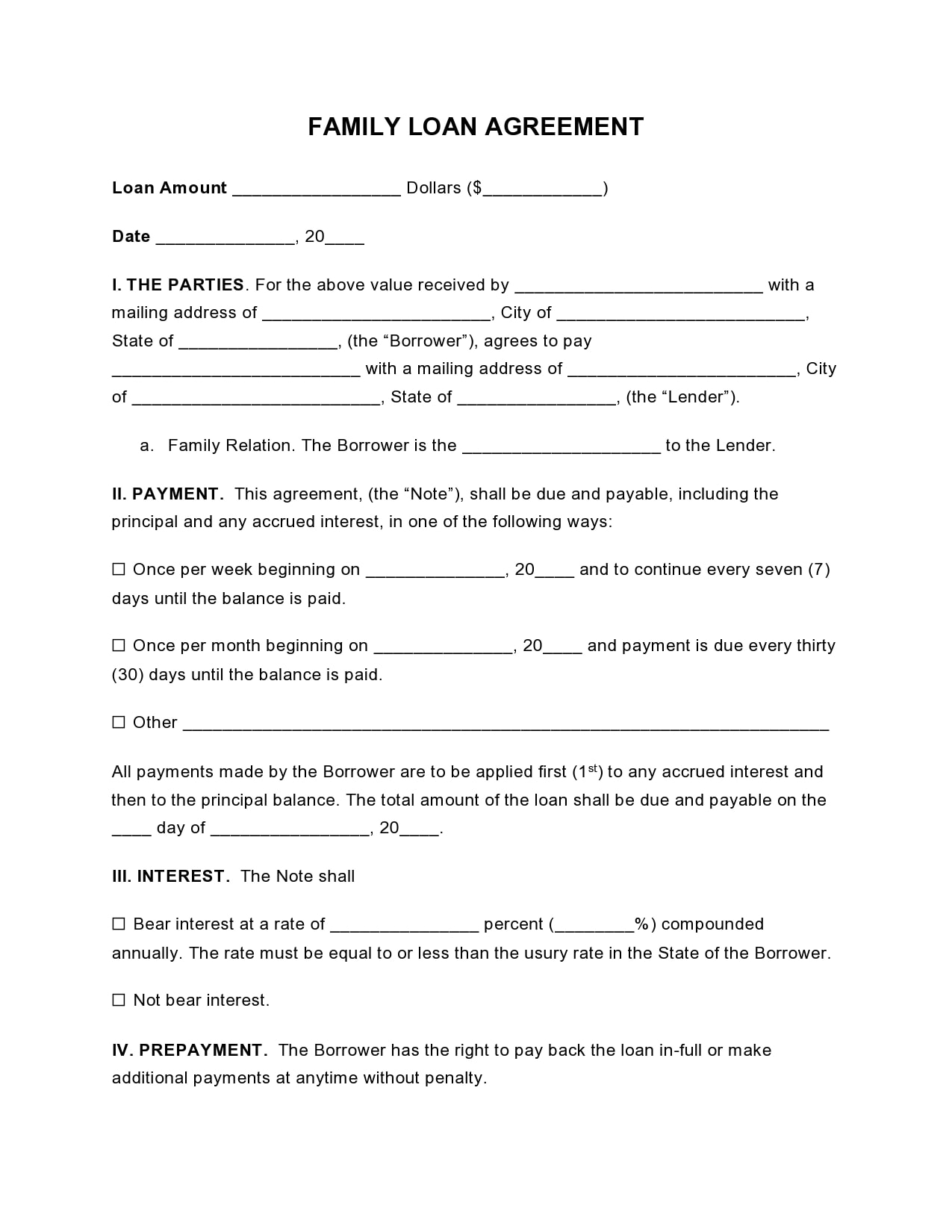

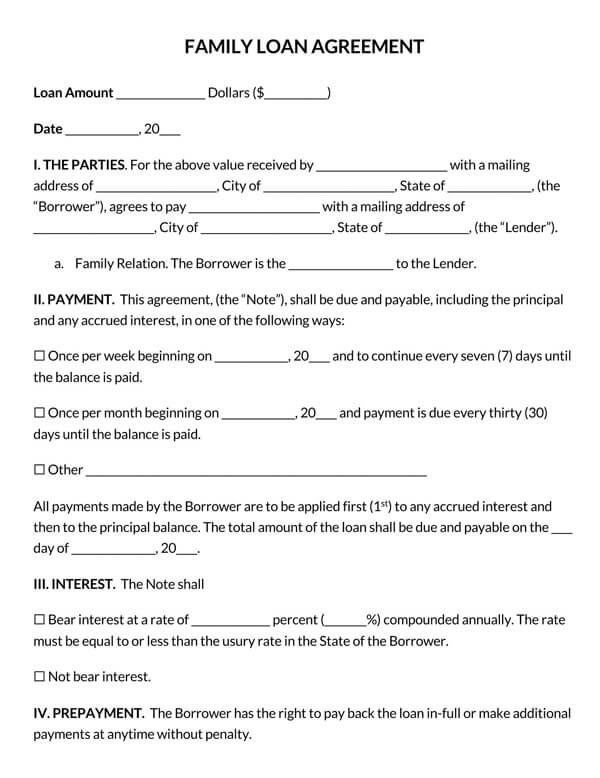

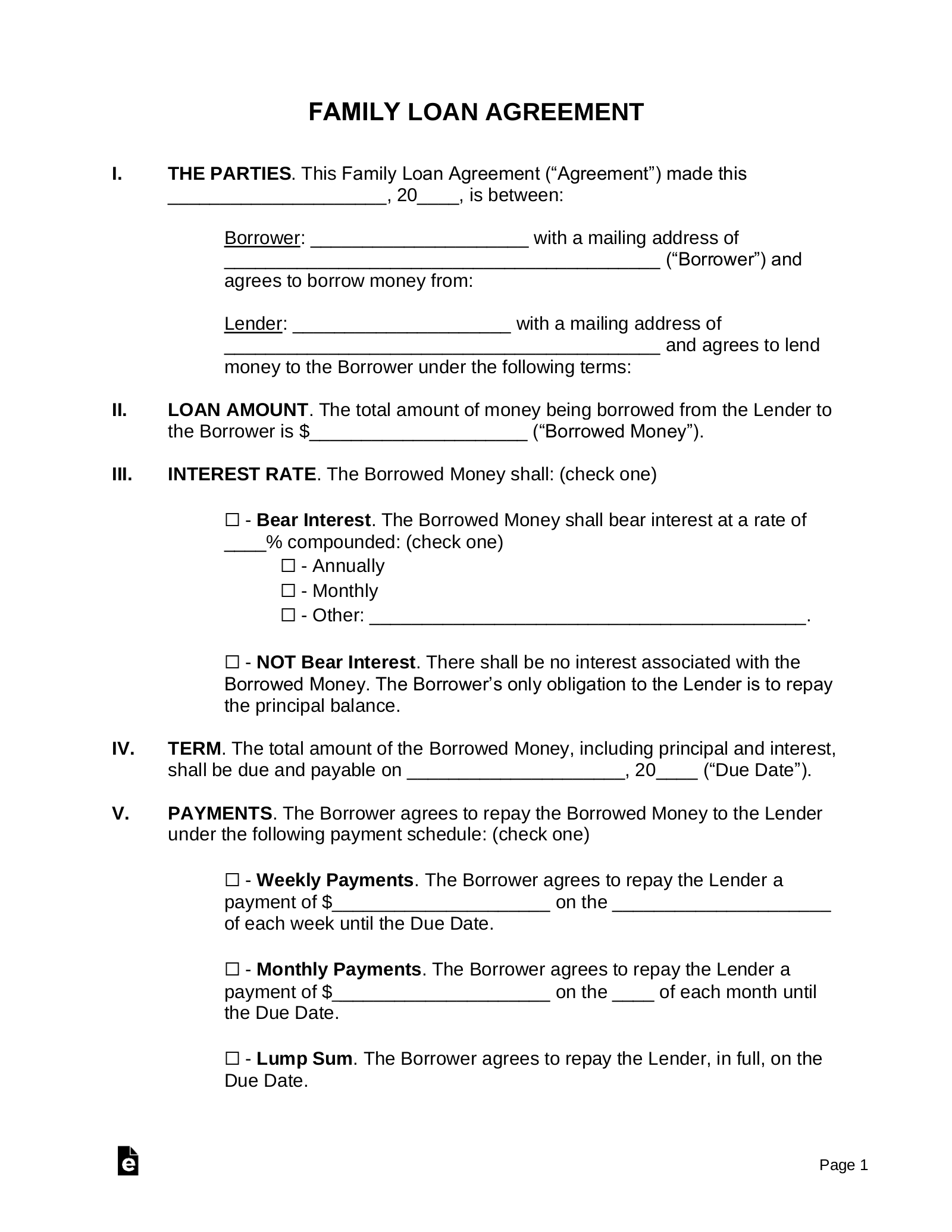

- Identification of Parties: Clearly identify all individuals involved in the loan, including full legal names, addresses, and contact information. This includes the borrower and the lender.

- Loan Amount and Purpose: Specify the exact amount of the loan, the intended use of the funds, and any specific conditions or restrictions related to its use. Be precise and unambiguous.

- Interest Rate and Repayment Schedule: Outline the interest rate (if any) and the repayment schedule. Consider factors like the borrower’s income and ability to repay. A fixed interest rate provides predictability, while a variable rate can be more appealing but requires careful monitoring.

- Repayment Terms: Detail the repayment schedule, including the frequency of payments (e.g., monthly, quarterly), the due date, and any penalties for late payments.

- Collateral (if applicable): If the loan is secured by assets (e.g., property, vehicles), clearly define the collateral and its value. A written agreement outlining the collateral and its value is essential.

- Default and Remedies: Define what constitutes a default, the consequences of default (e.g., loss of collateral, legal action), and the remedies available to the lender.

- Governing Law and Dispute Resolution: Specify the jurisdiction whose laws will govern the agreement and the method for resolving disputes (e.g., mediation, arbitration).

The Role of “Family Loan Agreement Template Free” in Drafting

The availability of a “Family Loan Agreement Template Free” is a significant advantage for many individuals seeking to establish a formal agreement. These templates provide a starting point, saving time and effort in drafting a document from scratch. However, it’s crucial to remember that these templates are general guidelines and must be adapted to the specific circumstances of the relationship. Don’t simply copy and paste; carefully review and modify the template to ensure it accurately reflects your needs and intentions. Many reputable legal websites offer free templates, but always verify their accuracy and suitability before using them. Consider using a template as a foundation, then tailoring it to your unique situation.

Protecting Your Interests: Important Considerations

Beyond the core components, several factors are critical for safeguarding your interests:

- Clear Communication: Open and honest communication is the cornerstone of any successful agreement. Discuss expectations, concerns, and potential issues openly and proactively.

- Fairness and Equity: Ensure that the terms of the agreement are fair and equitable to both parties. Avoid creating an imbalance of power.

- Contingency Planning: Consider potential scenarios that could arise, such as changes in circumstances (e.g., job loss, illness) or disagreements. Include provisions for addressing these situations.

- Termination Clause: Clearly define the conditions under which the agreement can be terminated, both by mutual agreement and by the lender.

- Tax Implications: Be aware of the tax implications of the loan, particularly if it’s a business loan. Consult with a tax professional.

The Importance of Legal Review

While a Family Loan Agreement Template Free can be a helpful starting point, it’s essential to have it reviewed by a qualified attorney before signing. An attorney can ensure that the agreement is legally sound, protects your interests, and complies with applicable laws. They can also advise you on the best way to structure the agreement to minimize risks and maximize benefits. Don’t rely solely on the information provided in the template; professional legal guidance is invaluable.

Beyond the Agreement: Maintaining a Healthy Relationship

A Family Loan Agreement is a tool, not a solution in itself. Maintaining a healthy and respectful relationship is paramount. Regular communication, trust, and a willingness to compromise are essential for a successful partnership. Addressing conflicts promptly and constructively can prevent them from escalating into major problems. Remember that the goal is to foster a mutually beneficial relationship, not to create a rigid contract that hinders communication and understanding.

Conclusion

Creating a Family Loan Agreement Template Free is a vital step in establishing a secure and sustainable financial relationship. By carefully considering the key components, understanding the importance of clear communication, and seeking professional legal advice, you can create an agreement that protects your interests and fosters a strong and lasting partnership. Remember that a well-drafted agreement is an investment in the future, promoting trust, transparency, and responsible financial management. Don’t underestimate the value of proactive planning and legal oversight. Ultimately, a thoughtfully crafted Family Loan Agreement can significantly reduce the risk of disputes and ensure a smooth and prosperous future for everyone involved.