The termination of a shareholders’ agreement is a significant event for any company, often triggering complex legal and financial considerations. It’s a strategic decision that can dramatically alter a business’s future, impacting ownership, governance, and operational structures. A well-drafted termination agreement is crucial to minimize disputes and ensure a smooth transition. This article will delve into the key aspects of termination, exploring the various scenarios, legal implications, and best practices for navigating this process. Understanding the nuances of termination is paramount for both departing shareholders and the company itself. The core of a successful termination agreement lies in clarity, fairness, and adherence to applicable laws. It’s not simply a “take it or leave it” scenario; careful planning and professional legal counsel are essential. This guide provides a comprehensive overview to help you understand the process and mitigate potential risks.

Understanding the Purpose of a Shareholders Agreement

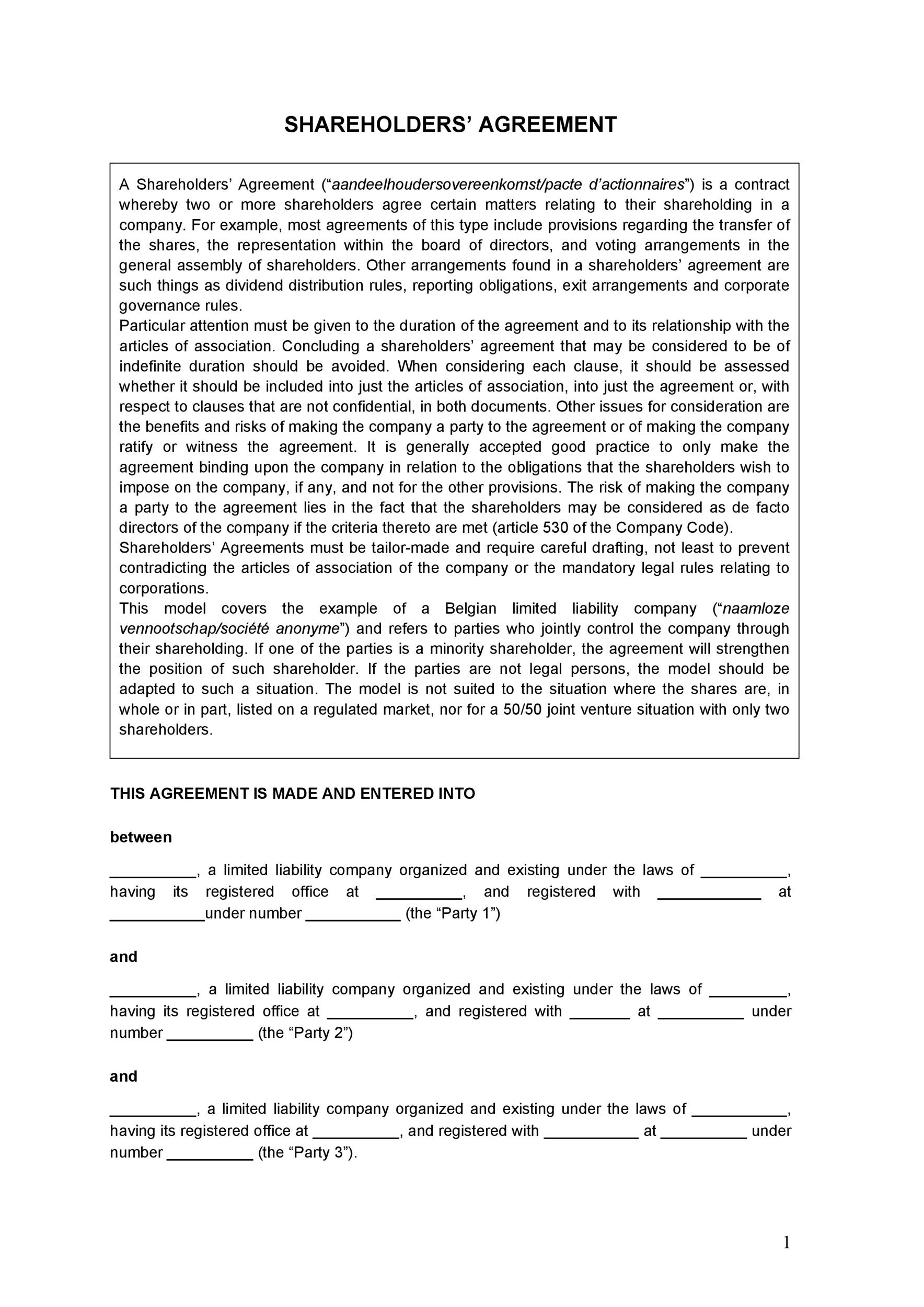

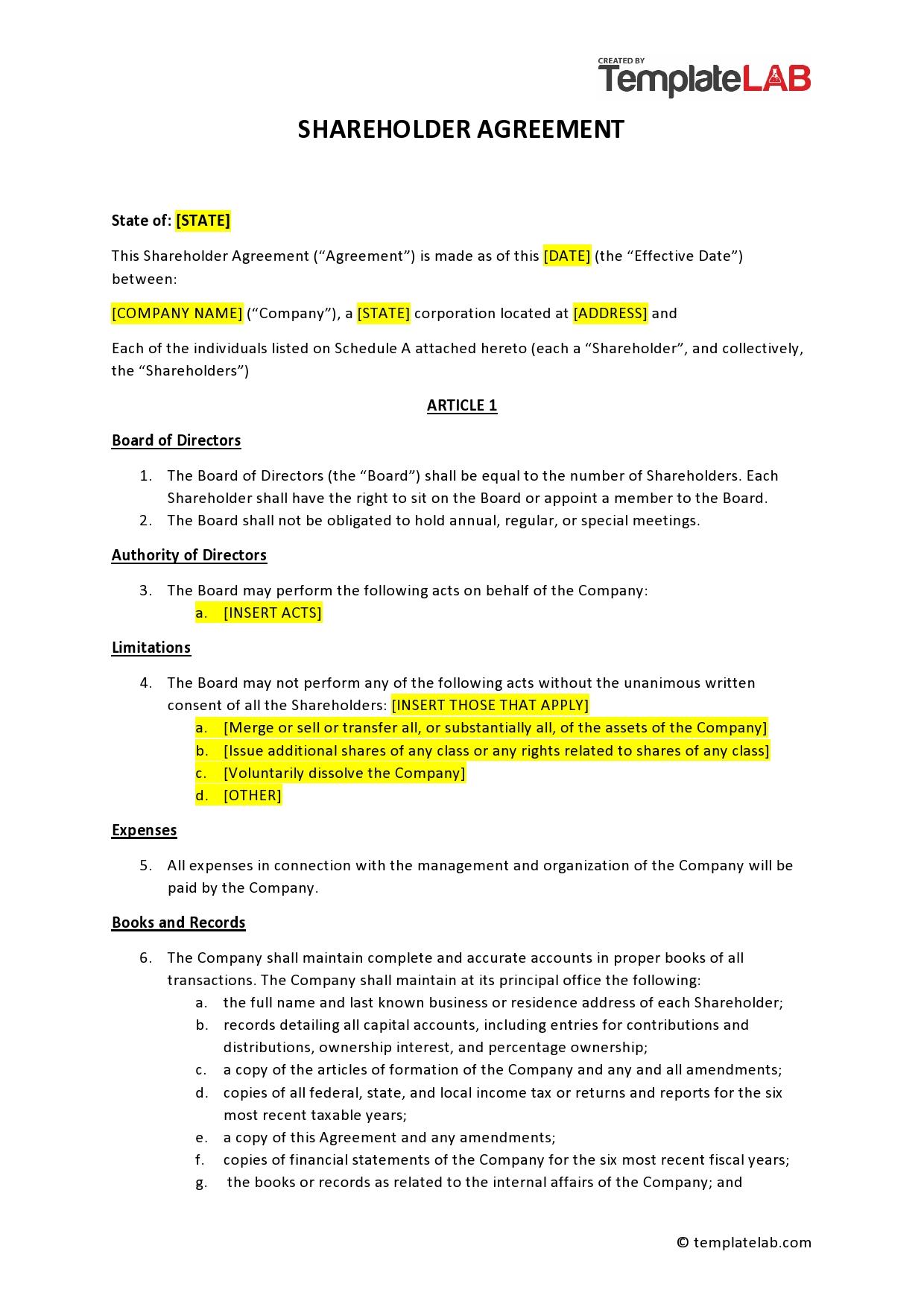

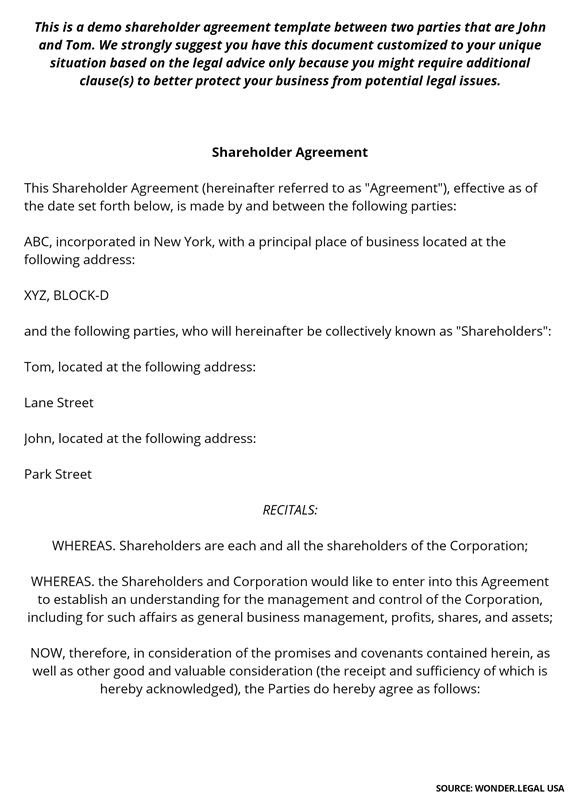

Before examining the termination process, it’s important to grasp the fundamental purpose of a shareholders’ agreement. This document outlines the rights, responsibilities, and obligations of shareholders, defining how decisions are made, how profits are distributed, and how disputes are resolved. It’s a vital tool for fostering a stable and collaborative business environment. A robust agreement can prevent costly litigation and ensure a smooth transfer of ownership when a shareholder leaves or the company is sold. Without a clearly defined agreement, the potential for conflict and uncertainty is significantly increased. The agreement often addresses critical issues like board representation, voting rights, and the process for dissolving the company.

Key Scenarios Leading to Termination

Several factors can trigger the need to terminate a shareholders’ agreement. These scenarios often require careful consideration and potentially necessitate amendment or renegotiation. Common reasons for termination include:

- Shareholder Departure: The most frequent reason. Shareholders may choose to leave the company, either voluntarily or due to a change in their personal circumstances.

- Change in Control: A significant change in ownership, such as a merger, acquisition, or sale of a majority stake, can necessitate termination.

- Breach of Contract: If a shareholder breaches the terms of the agreement, the company may have grounds to terminate the agreement.

- Disagreement on Strategic Direction: Significant disagreements about the company’s future strategy can lead to a breakdown in the agreement and a potential termination.

- Financial Distress: If the company faces severe financial difficulties, the agreement may be terminated to protect the interests of remaining shareholders.

- Change in Legal or Regulatory Requirements: New laws or regulations may necessitate a change in the company’s structure or governance, potentially triggering termination.

The Termination Process – A Step-by-Step Guide

The termination process typically involves a series of steps, each requiring careful attention. It’s crucial to document all actions and communications thoroughly.

- Notification and Formal Communication: The departing shareholder must formally notify the company of their intention to terminate the agreement. This notification should be documented in writing and ideally delivered via certified mail with return receipt requested.

- Review and Amendment: The company’s legal counsel will typically review the agreement to determine the best course of action. This may involve amending the agreement to reflect the termination and address any outstanding issues.

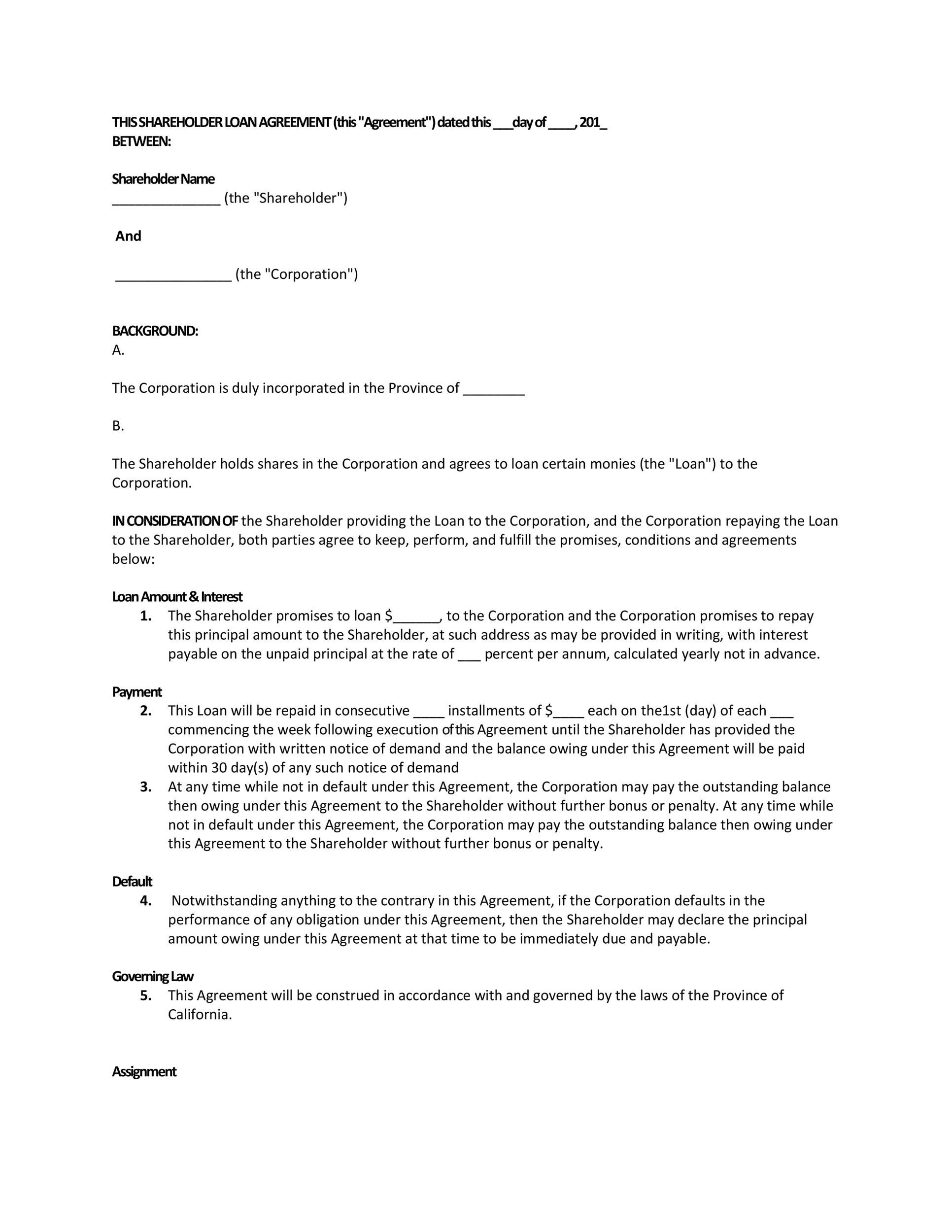

- Distribution of Assets: The company will need to determine how to distribute the company’s assets to the shareholders, following the terms outlined in the agreement. This often involves a process of valuation and payment.

- Payment of Liabilities: Shareholders may be liable for certain debts or obligations incurred by the company during the termination period. The agreement should address how these liabilities will be addressed.

- Transition of Key Personnel: The company will need to ensure a smooth transition of key personnel, particularly those involved in the company’s operations.

- Final Accounting and Reporting: A final accounting and reporting must be completed to provide a clear record of the termination process.

Specific Clauses Addressing Termination

Several clauses within a shareholders’ agreement are particularly relevant to the termination process. These include:

- Termination for Cause: This clause outlines the circumstances under which the agreement can be terminated due to a breach of contract by a shareholder.

- Termination for Convenience: This clause allows shareholders to terminate the agreement for any reason, subject to certain conditions.

- Right of First Refusal: This clause gives shareholders the right to terminate the agreement if another shareholder expresses interest in acquiring the company.

- Valuation of Assets: The agreement should clearly define how the company’s assets will be valued upon termination.

- Distribution of Residual Assets: The agreement should specify how the remaining assets will be distributed to the shareholders.

Legal Considerations and Compliance

Termination of a shareholders’ agreement is subject to numerous legal requirements. It’s essential to ensure compliance with applicable state and federal laws. These include:

- State Law: State laws governing shareholder agreements vary significantly.

- Securities Laws: If the company is publicly traded, compliance with securities laws is critical.

- Tax Laws: The termination may have tax implications for shareholders.

- Contract Law: The termination must be properly documented and executed according to the principles of contract law.

The Role of Legal Counsel

Given the complexity of termination agreements, it’s highly recommended to engage experienced legal counsel. A lawyer specializing in corporate law and shareholder agreements can:

- Review the agreement to ensure it’s compliant with applicable laws.

- Advise on the best course of action for termination.

- Negotiate the terms of the termination agreement.

- Represent the company’s interests throughout the process.

Risk Mitigation Strategies

Proactive risk mitigation is key to minimizing potential complications during a termination. Here are some strategies:

- Clear and Comprehensive Agreement: A well-drafted agreement is the foundation of a successful termination.

- Regular Review: Periodically review the agreement to ensure it remains relevant and compliant.

- Documentation: Maintain thorough records of all communications and actions related to the termination.

- Due Diligence: Conduct thorough due diligence on potential buyers or successors to the company.

Conclusion

Termination of a shareholders’ agreement is a complex but essential process. A carefully drafted agreement, coupled with proactive legal counsel, can minimize risks and ensure a smooth transition for all stakeholders. Understanding the various scenarios, legal implications, and best practices is crucial for both departing shareholders and the company itself. By prioritizing clarity, fairness, and compliance, businesses can navigate this process effectively and protect their interests. The key takeaway is that a well-executed termination agreement is not merely a formality; it’s a strategic tool for managing change and preserving the long-term value of the company.