The world of finance can sometimes feel complex and daunting, especially when it comes to understanding investment options. For many individuals, navigating the landscape of stocks and bonds requires a solid understanding of the underlying structures and documents. One of the most frequently requested documents is the stock certificate, and thankfully, a readily available template can simplify the process. This article will delve into the world of stock certificate templates, exploring their benefits, features, and how to use them effectively. Stock Certificate Template Word is a powerful tool for anyone seeking to clearly and professionally document their investment holdings. It’s more than just a formality; it’s a crucial element for tax reporting, record-keeping, and maintaining transparency with your financial advisor. Let’s explore how to create and utilize a stock certificate template word.

Understanding the Importance of Stock Certificates

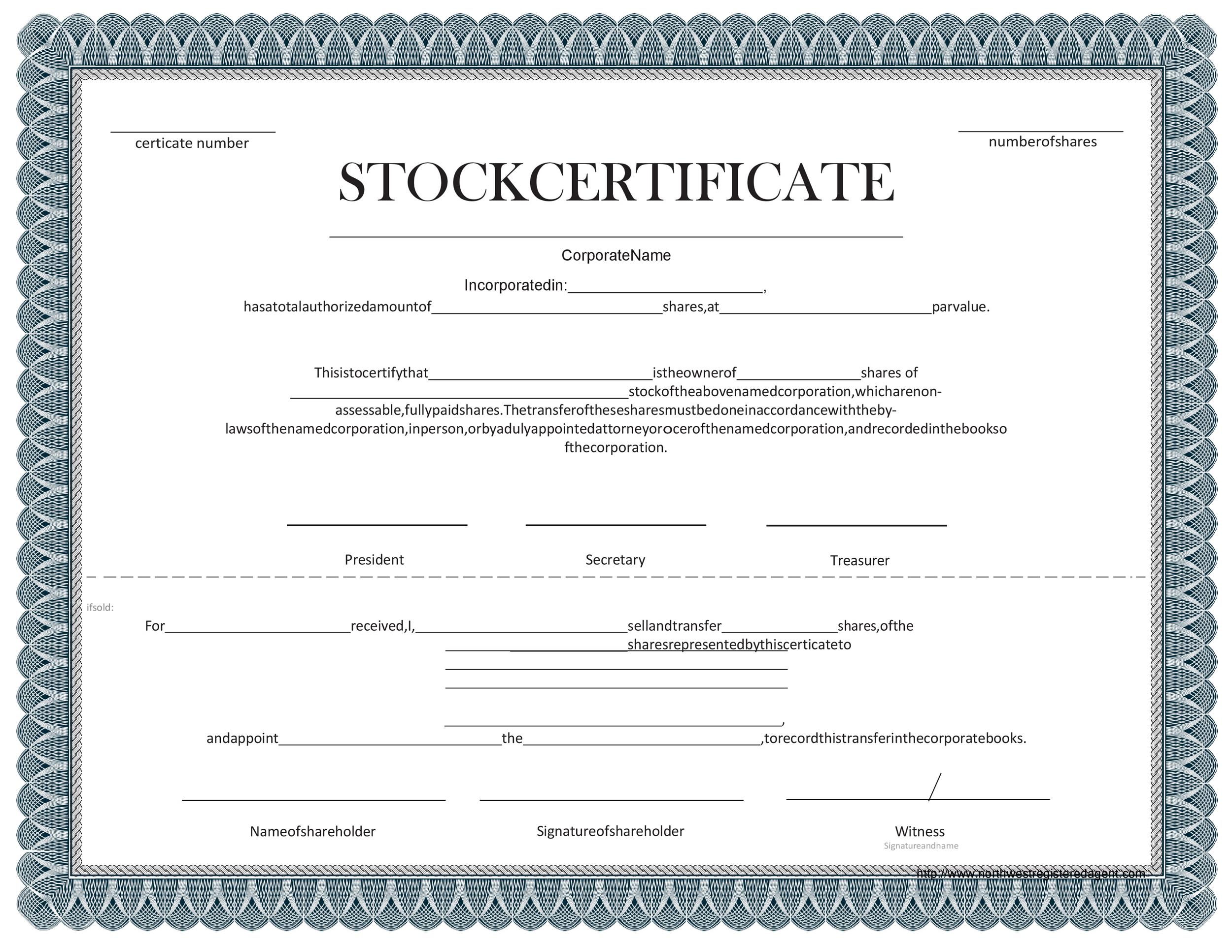

A stock certificate is a formal record of your ownership in a company. It’s a document that details the number of shares you hold, the par value of each share, and the certificate number. It’s a vital piece of documentation for several reasons. Firstly, it’s essential for tax reporting. The IRS requires companies to provide stock certificates to individuals for tax purposes. Secondly, it’s crucial for maintaining accurate records of your investment portfolio. This is particularly important for estate planning and for tracking your investment growth over time. Finally, a well-maintained stock certificate can be beneficial for verifying the authenticity of your investment holdings with your broker or financial institution. Without a clear record, it can be difficult to demonstrate your investment position accurately. The availability of a standardized template ensures consistency and ease of use, making it a valuable asset for anyone managing their investments.

Key Features of Stock Certificate Templates

Several different types of stock certificate templates are available, each offering varying levels of detail and customization. Here’s a breakdown of some of the most common features:

- Basic Template: This is the most straightforward template, typically including the company name, stock ticker symbol, number of shares, par value, certificate number, and the investor’s name and address. It’s a good starting point for individuals with simple investment holdings.

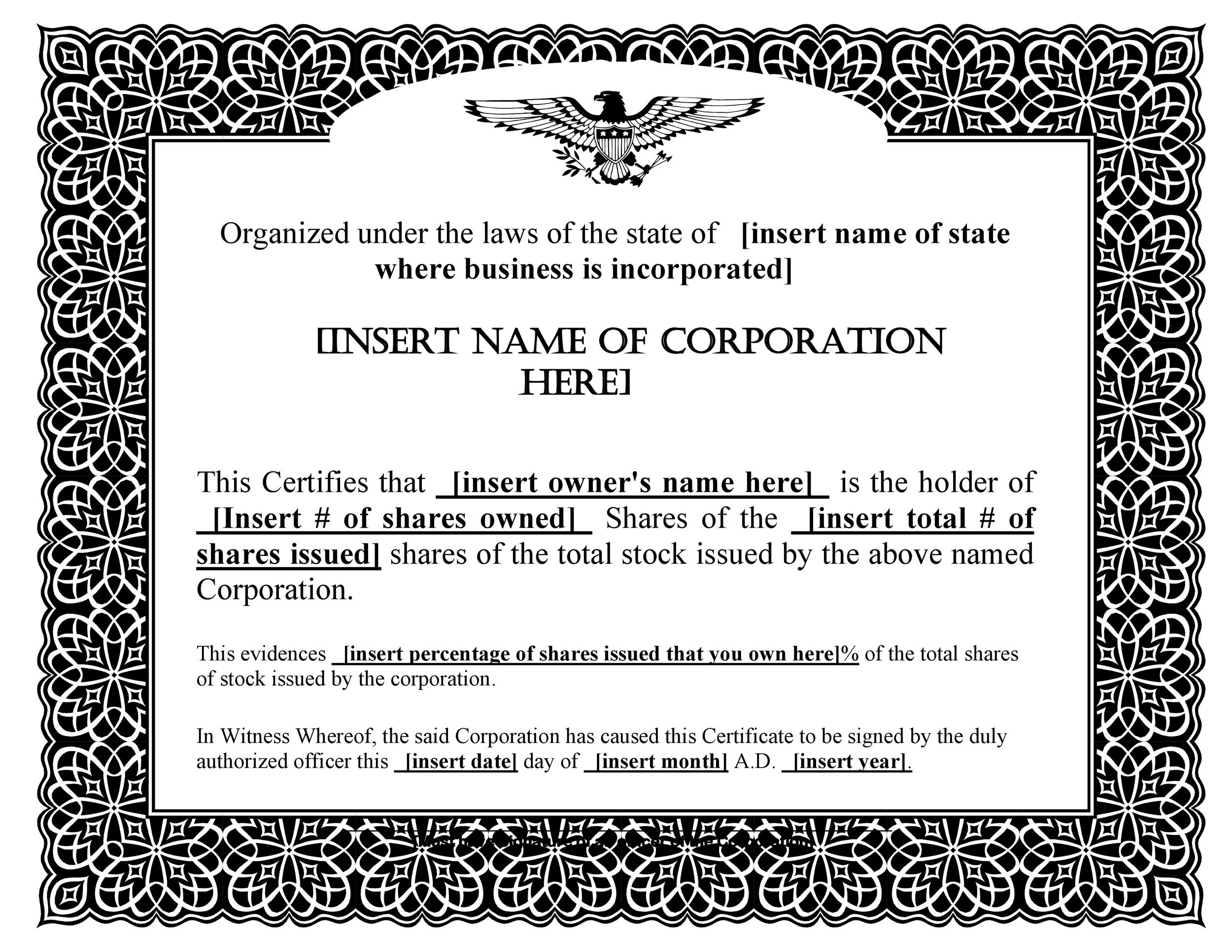

- Detailed Template: This template goes beyond the basic version, often including information such as the date of issuance, the company’s financial statements, and the certificate’s expiration date. It’s ideal for investors who want a more comprehensive record of their investment.

- Customizable Templates: Some templates allow for customization, enabling users to add specific information relevant to their individual investment strategy. This might include details about the investment’s underlying assets or the investor’s investment goals.

- Digital Templates: Many templates are now available as digital documents, which can be easily shared and printed. This offers convenience and eliminates the need for physical copies.

Creating Your Own Stock Certificate Template

While pre-made templates are readily available, you can also create your own. Here’s a step-by-step guide:

- Gather Information: Collect all the necessary information, including the company’s name, ticker symbol, number of shares, par value, certificate number, and your name and address.

- Choose a Template: Select a template that best suits your needs. Many free templates are available online.

- Customize the Template: Modify the template to include all the relevant information. Don’t hesitate to add or remove fields as needed.

- Proofread Carefully: Double-check all the information for accuracy before submitting the template. Errors can lead to confusion and delays.

- Save the Template: Save the template as a PDF file for easy sharing and printing.

The Importance of Accuracy and Compliance

The accuracy of your stock certificate is paramount. Incorrect information can lead to significant problems with tax reporting and compliance. Always double-check all details before submitting your template. Furthermore, be aware of any specific requirements outlined by your brokerage firm or tax authority. Many institutions have specific formatting guidelines for stock certificates. Failure to comply with these guidelines can result in penalties. Maintaining a clear and accurate record of your investment holdings is a fundamental responsibility for any investor.

Stock Certificate Template Word – A Practical Guide

The stock certificate template word is a versatile tool for managing your investment portfolio. It’s more than just a document; it’s a representation of your ownership and a crucial component of your overall financial strategy. The ability to easily access and update this information streamlines your tax reporting and provides a clear record of your investment position. Consider using this template as a foundation for a more comprehensive investment tracking system.

Tax Implications of Stock Certificates

Understanding the tax implications of stock certificates is essential for maximizing your tax benefits. Generally, the tax treatment depends on the type of stock and the investor’s individual circumstances. For example, capital gains taxes may apply when you sell shares, and dividend income may be taxable. Consulting with a qualified tax advisor is recommended to ensure you comply with all applicable tax laws. The template can be used to calculate your capital gains and losses, facilitating accurate tax reporting.

Beyond the Basics: Advanced Stock Certificate Features

While the basic stock certificate template provides a solid foundation, there are several advanced features that can enhance its functionality. Some templates include:

- Certificate Expiration Date: A field to specify the expiration date of the certificate.

- Brokerage Information: A section to include your brokerage account number and the name of your broker.

- Investment Type: A field to specify the type of investment (e.g., common stock, bond, mutual fund).

- Portfolio Summary: A summary of your investment holdings, including the total value of your portfolio.

These additions provide a more complete picture of your investment portfolio and can be particularly useful for investors who are managing multiple investments.

Utilizing Stock Certificate Templates for Estate Planning

Stock certificate templates are invaluable for estate planning purposes. They provide a clear and documented record of your investment holdings, which can be used to determine the value of your estate and to ensure that your beneficiaries receive the expected distribution. A well-maintained stock certificate can simplify the probate process and reduce potential disputes among heirs. It’s a valuable tool for ensuring a smooth and transparent transfer of wealth.

Choosing the Right Stock Certificate Template

Selecting the right stock certificate template depends on your individual needs and preferences. Consider the following factors:

- Complexity: Do you need a simple template or a more detailed one?

- Data Requirements: What information do you need to include?

- Ease of Use: How easy is the template to use and customize?

- Cost: Are you looking for a free template or are you willing to pay for a premium version?

Many reputable financial websites and brokerage firms offer free stock certificate templates. Researching different options and choosing a template that meets your specific requirements is crucial.

Conclusion

Stock certificate templates are an indispensable tool for investors of all levels. They provide a clear, concise, and legally compliant record of your investment holdings, simplifying tax reporting, maintaining accurate records, and facilitating estate planning. By understanding the benefits and features of different templates, and by utilizing the template effectively, you can gain greater control over your investments and ensure a smoother financial future. Investing in a well-maintained stock certificate template is an investment in your financial well-being. Remember to always consult with a qualified financial advisor for personalized advice.