Creating professional invoices is a cornerstone of any business, regardless of size. For many freelancers and self-employed individuals, the process can feel daunting, especially when it comes to designing and producing accurate, legally compliant invoices. That’s where a well-crafted self-employed invoice template Uk comes in. This guide will explore the essential elements of creating a professional invoice, specifically tailored for UK-based freelancers and small businesses. We’ll cover everything from choosing the right template to ensuring compliance with UK regulations. Self Employed Invoice Template Uk is more than just a design; it’s a crucial tool for managing your finances and establishing clear communication with your clients. This article will provide you with the knowledge and resources you need to confidently create and utilize a template that works for you.

The UK’s business landscape demands a level of professionalism, and invoices are a fundamental part of that. A poorly designed invoice can lead to disputes, delays, and damage to your reputation. Conversely, a well-structured and professionally presented invoice builds trust and demonstrates your commitment to clear financial transactions. Choosing the right template is the first step – a template that’s both visually appealing and legally sound is paramount. This guide will focus on providing you with a selection of excellent templates and highlighting key considerations for UK-specific requirements.

Understanding the Basics of UK Invoice Requirements

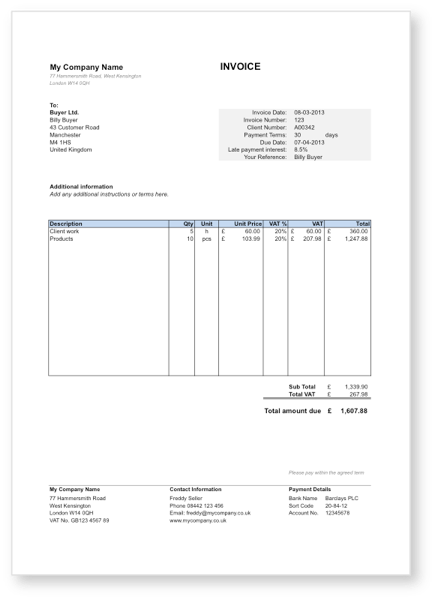

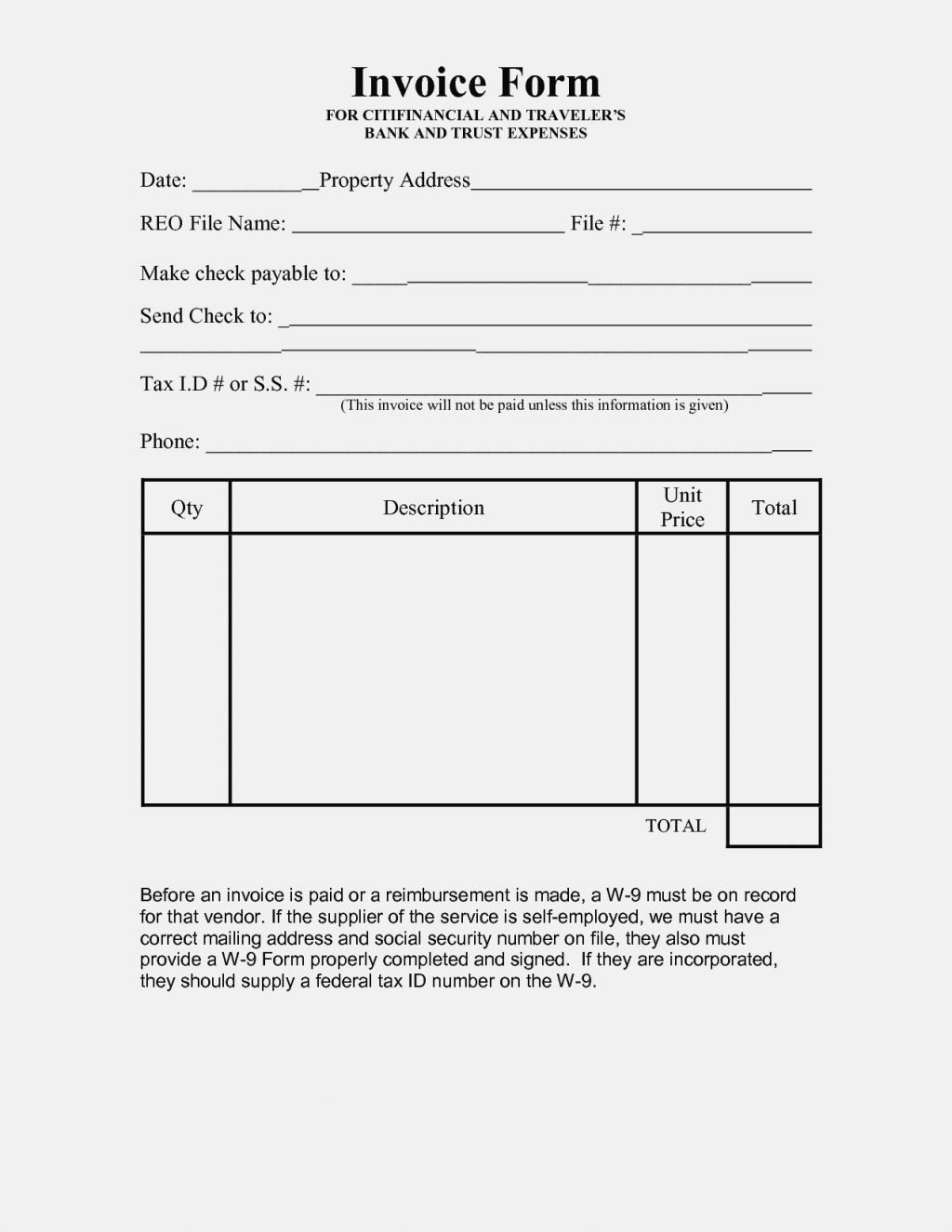

Before diving into template selection, it’s essential to understand the key requirements of UK invoices. The primary legislation governing invoices is the Accounts and Payable Regulations 2012. These regulations dictate the format, content, and required information that must be included on invoices. Specifically, invoices must include:

- Invoice Number: A unique identifier for each invoice.

- Invoice Date: The date the invoice was issued.

- Client Details: Name, address, and contact information of the client.

- Description of Services/Goods: A clear and detailed description of what was provided.

- Quantity & Price: The amount of each item or service charged.

- Total Amount Due: The final amount owed.

- Payment Terms: Clearly state the payment due date and accepted methods.

- Bank Details: Information for receiving payments.

- VAT (Value Added Tax) Information: If applicable, the VAT rate and amount.

Failure to comply with these regulations can result in penalties and legal issues. It’s crucial to consult with an accountant or legal professional to ensure your invoices are fully compliant.

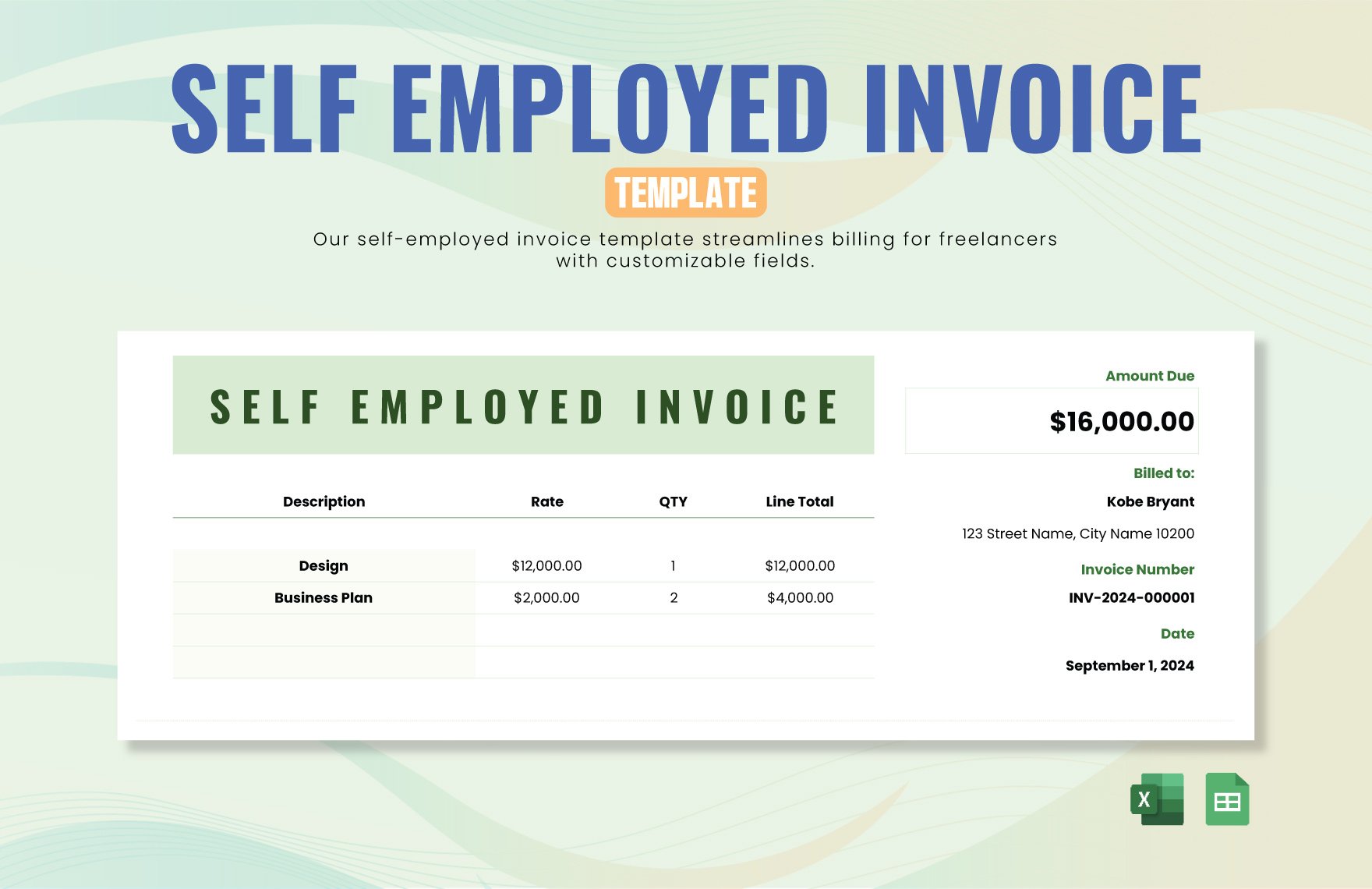

Choosing the Right Self-Employed Invoice Template

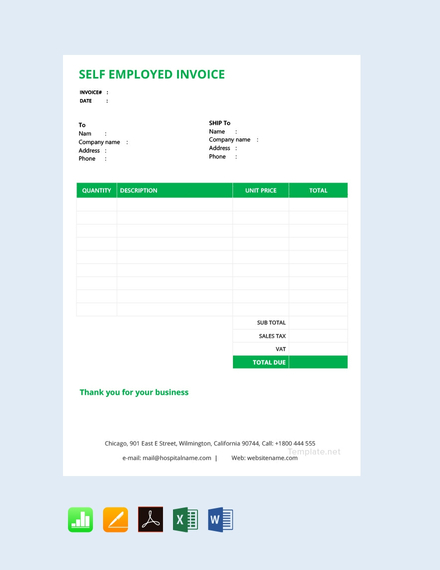

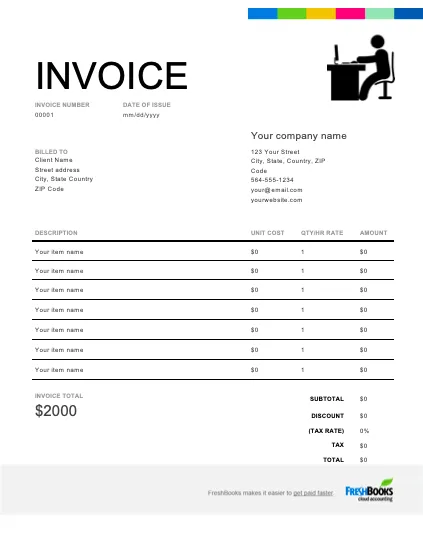

Numerous invoice template options are available, catering to different needs and budgets. Here are a few popular choices, each with its own strengths:

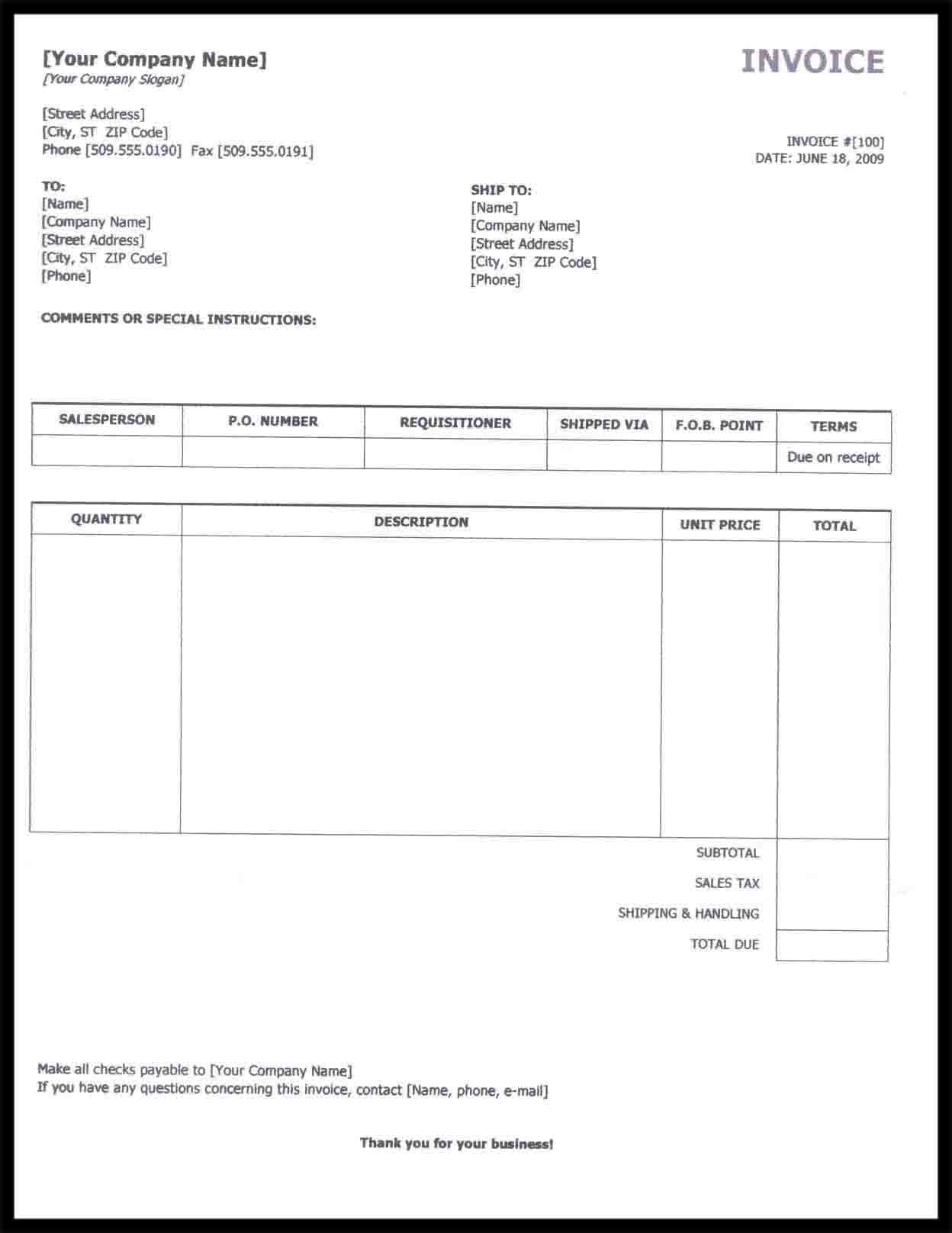

- Microsoft Word Templates: Many free and paid Microsoft Word templates offer a solid foundation for creating invoices. These are readily available online and easy to customize. Look for templates that are specifically designed for freelancers and small businesses.

- Canva Templates: Canva is a user-friendly graphic design platform that provides a wide range of invoice templates. They’re particularly popular for their visually appealing designs and ease of use. Many of their templates are free to use, with paid options for more advanced features.

- Invoice Ninja: This is a dedicated invoicing software with a range of customizable templates. It’s a good option if you want a more robust solution with features like automated invoicing and payment tracking.

- Google Docs Templates: Google Docs offers basic invoice templates that are suitable for simple transactions. They’re a free and accessible option, but may require more customization.

When selecting a template, consider:

- Ease of Use: How easy is it to create and customize the invoice?

- Cost: Are there any subscription fees or additional costs associated with the template?

- Features: Does the template offer the features you need, such as payment tracking or tax calculation?

- UK Compliance: Ensure the template adheres to UK regulations.

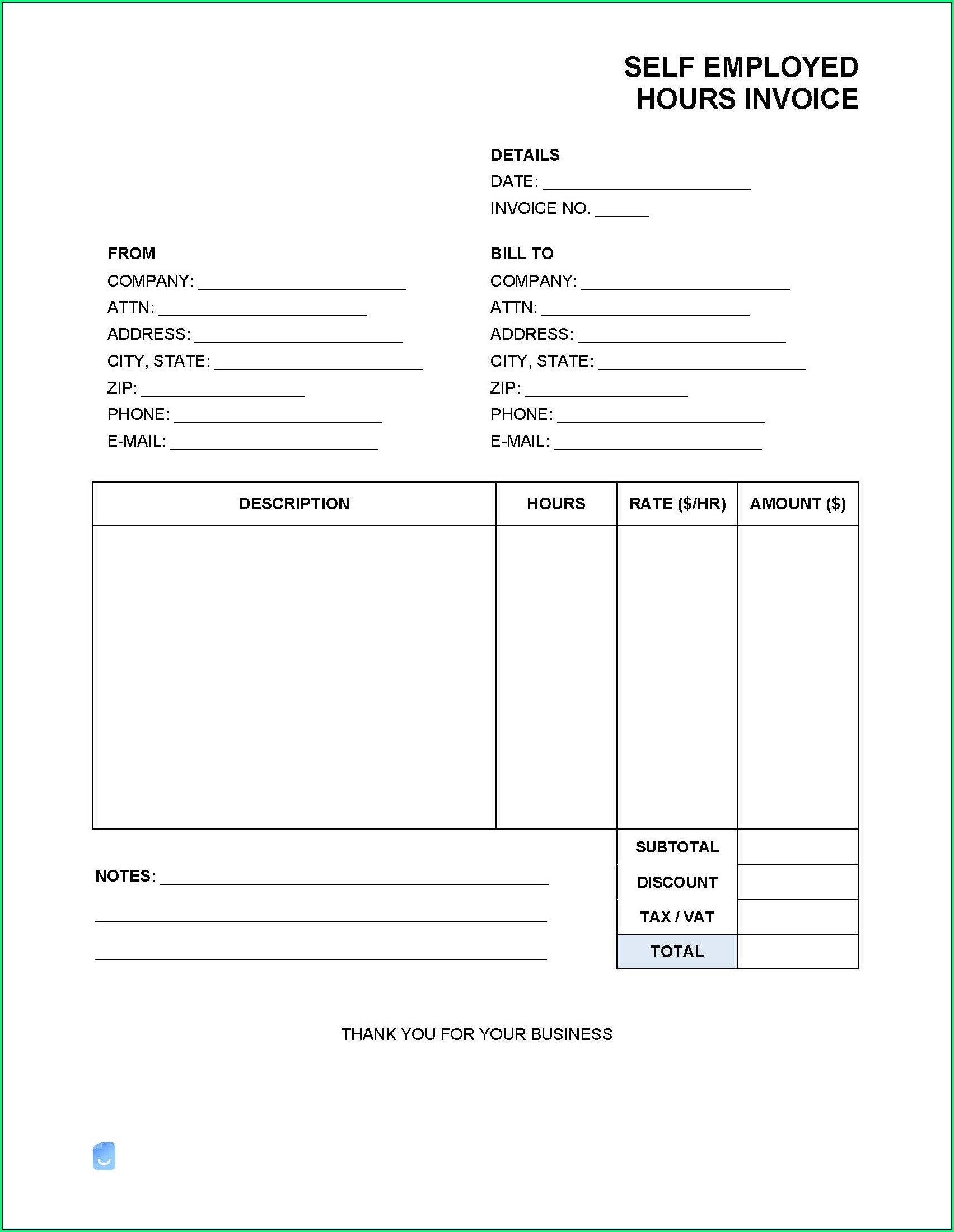

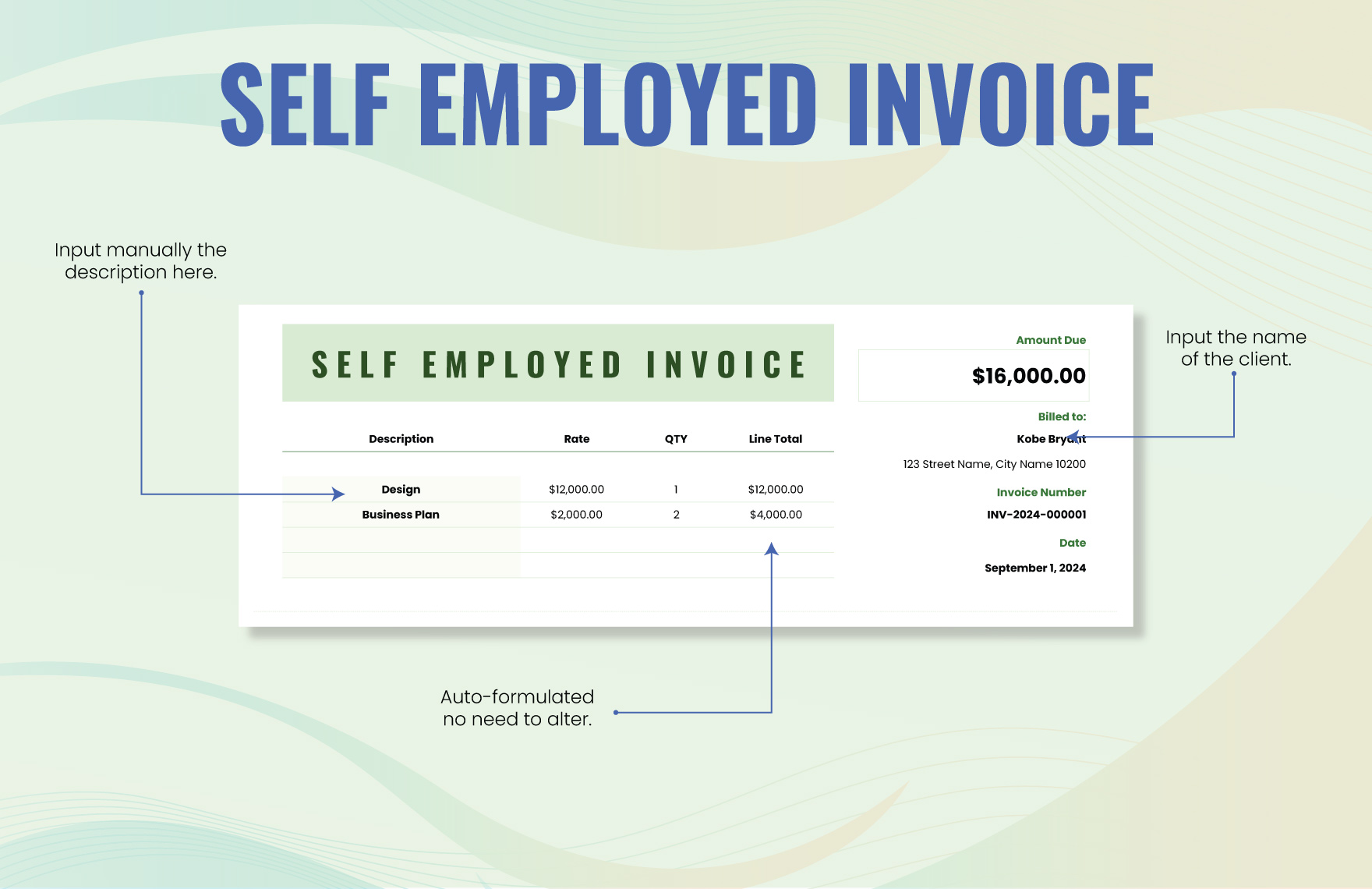

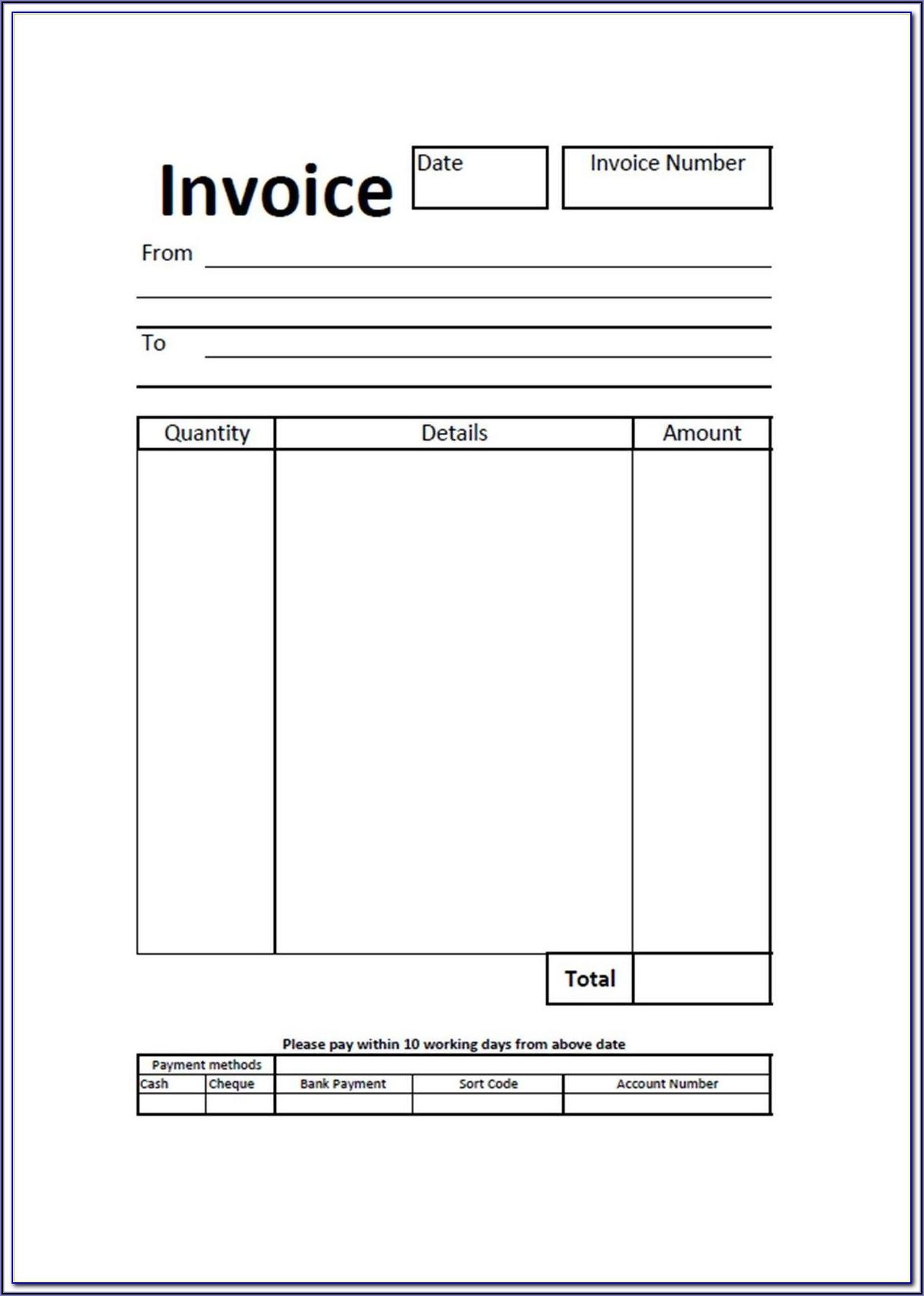

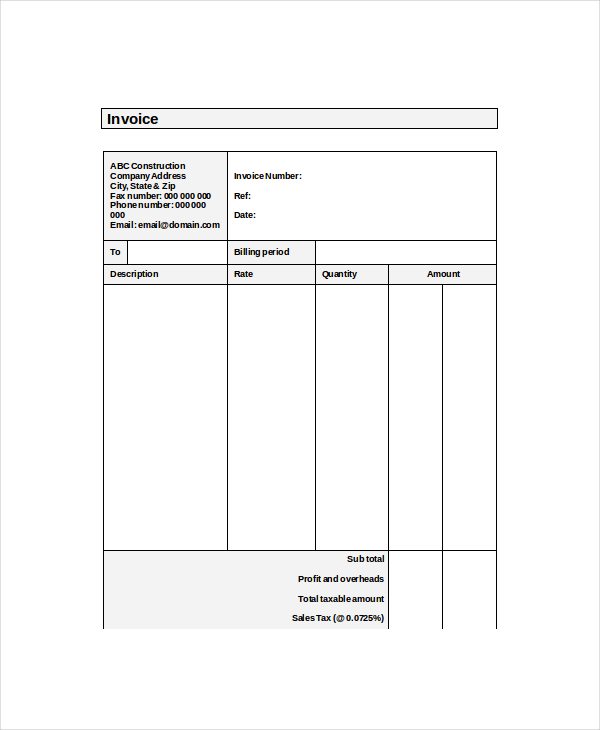

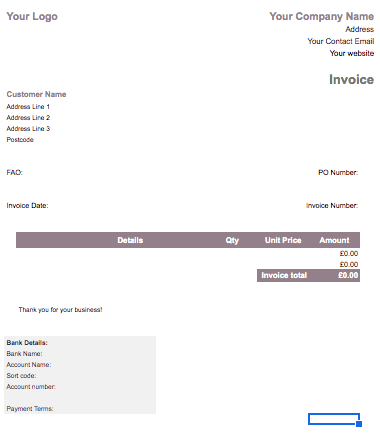

Section Breakdown: Key Sections for a Professional Invoice

Let’s examine how to structure your invoice using the provided sections:

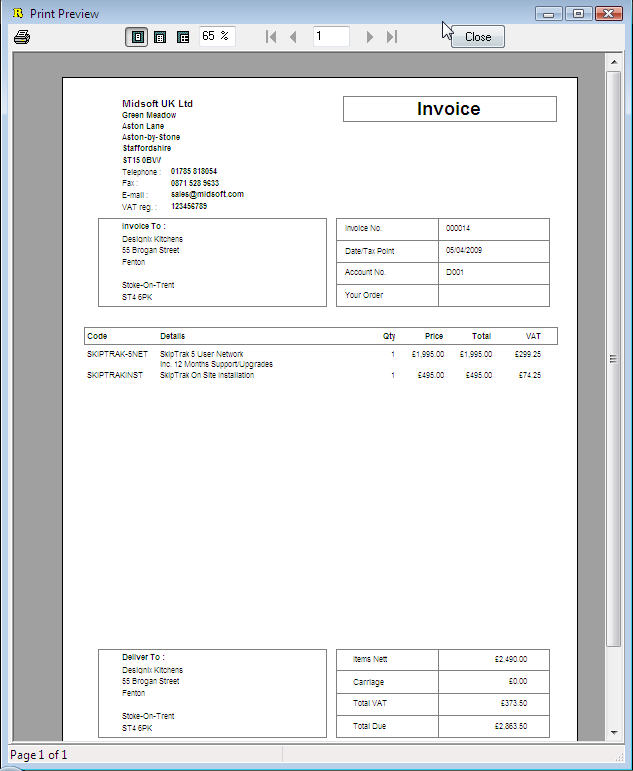

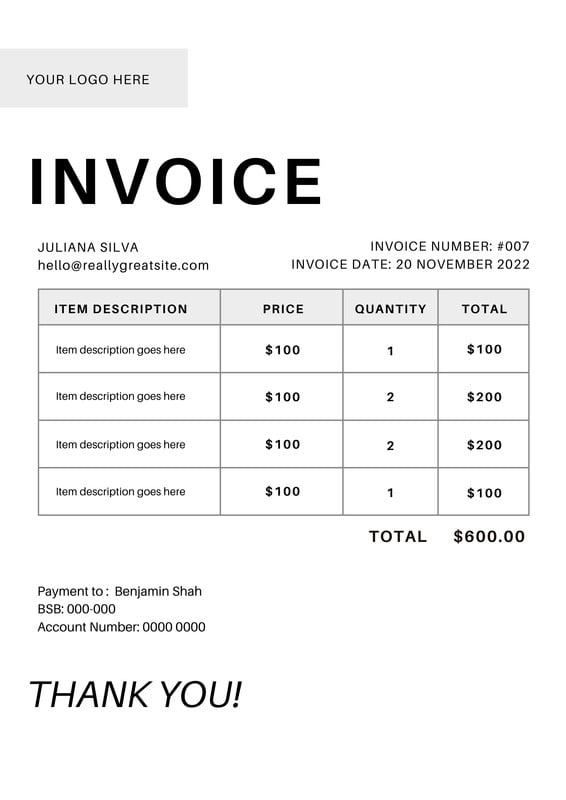

1. Header Information – Essential Details

The first section of your invoice should include essential details, immediately establishing your credibility. This includes:

- Invoice Number: A unique identifier for each invoice. This is critical for tracking and organization. Ensure it’s consistently formatted.

- Invoice Date: The date the invoice was issued.

- Client Details: Clearly state the client’s name, address, and contact information. Double-check this information for accuracy.

- Your Business Details: Include your business name, address, and contact information. This helps clients easily identify you.

2. Services/Goods Provided – Detailed Description

This section is where you clearly outline the services or goods you provided. Be specific! Instead of saying “Website Design,” specify “Design of a new website for [Client Name] including [Specific Features].” Include the quantity of each item or service.

3. Pricing – Clear and Transparent

This is where you present the price for each item or service. Use a consistent format for all prices. Clearly state the currency (e.g., GBP). Consider including a breakdown of costs if applicable.

4. Total Amount Due – The Final Calculation

This section summarizes the total amount due, including all charges. Clearly state the total amount owed, including VAT (if applicable).

5. Payment Terms – Important Communication

Clearly state the payment terms. This should include:

- Payment Due Date: Specify the date by which payment is expected.

- Accepted Payment Methods: List the accepted payment methods (e.g., bank transfer, PayPal, cheque).

- Late Payment Fees: If applicable, clearly state any late payment fees.

6. Bank Details – Facilitating Payments

Provide your bank details for receiving payments. Include the bank name, account number, and sort code.

7. VAT Information – Compliance

If your business is required to charge VAT, include the VAT rate and the amount. This is a crucial element for compliance.

8. Terms and Conditions – Optional but Recommended

Consider adding a brief terms and conditions section, outlining your payment policies and dispute resolution process. This can help protect your business.

9. Signature & Date – Professional Touch

Always include a signature line and a date. This adds a professional touch and confirms that the invoice has been reviewed and approved.

10. Attachments (Optional)

You can include relevant attachments, such as contracts or invoices.

Additional Considerations for UK Freelancers

- Record Keeping: Maintain meticulous records of all invoices issued and received.

- Tax Obligations: Understand your tax obligations and ensure your invoices accurately reflect your tax liability.

- Professionalism: Always present your invoices in a professional and well-formatted manner.

- Digital Invoice Options: Consider using digital invoicing software to streamline the process and improve efficiency.

Conclusion

Creating a professional self-employed invoice template Uk is an investment in your business’s financial health and reputation. By carefully considering the requirements of UK regulations, choosing the right template, and meticulously detailing your invoices, you can ensure compliance, build trust with your clients, and streamline your financial management. Remember that clear, concise, and legally compliant invoices are essential for success in the UK business environment. Investing time in creating a well-structured invoice is a worthwhile investment that will pay dividends in the long run. Don’t underestimate the importance of a professional invoice – it’s a fundamental element of good business practice.

.jpeg)