The process of probate can be a complex and emotionally draining experience for many families. Navigating legal proceedings, dealing with estate administration, and ultimately, settling the estate can be overwhelming. A crucial step in this process is obtaining a Probate Valuation Letter, a document that provides an independent assessment of the value of the deceased’s assets. This letter is essential for tax purposes, insurance claims, and various legal proceedings. This article will guide you through creating a professional and informative Probate Valuation Letter Template, ensuring clarity and accuracy. Understanding the purpose and proper formatting of this document is vital for a smooth and efficient probate process. Probate Valuation Letter Template – a well-crafted letter can significantly streamline the process and protect your interests.

The primary function of a Probate Valuation Letter is to provide a professional and objective estimate of the value of the deceased’s assets. It’s not simply a guess; it’s a calculated assessment based on verifiable data, typically obtained through appraisals and expert opinions. Without a properly prepared Valuation Letter, estate administration can be delayed, and potential disputes can arise. It’s a critical tool for tax purposes, allowing for accurate reporting of estate income and minimizing potential tax liabilities. Furthermore, it’s often required for insurance claims, providing a basis for assessing damages and coverage. The letter serves as a documented record of the estate’s assets, offering a clear picture for all involved. It’s a cornerstone of a successful and legally sound probate process.

Understanding the Purpose of a Probate Valuation Letter

Before diving into the template itself, let’s solidify the why behind this document. A Probate Valuation Letter isn’t just a formality; it’s a vital tool for several reasons. Firstly, it provides a reliable estimate of the estate’s worth, which is crucial for tax reporting. Different tax jurisdictions have varying requirements, and a Valuation Letter ensures compliance. Secondly, it’s essential for insurance claims. Insurance companies often require a Valuation Letter to determine the extent of damages and coverage. Thirdly, it facilitates estate planning and can be used in legal proceedings to establish the estate’s value. Finally, it offers a documented record of the estate’s assets, which can be invaluable for future estate administration or potential disputes. A clear and accurate Valuation Letter minimizes ambiguity and reduces the likelihood of costly disagreements.

Key Components of a Probate Valuation Letter Template

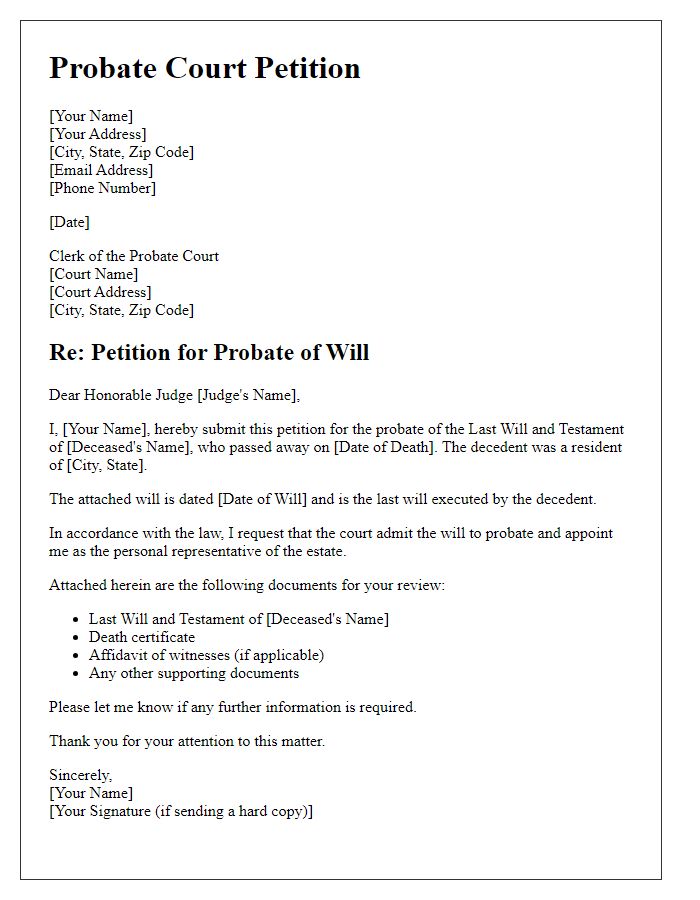

Creating a comprehensive and professional Probate Valuation Letter Template requires careful attention to detail. Here’s a breakdown of the essential components:

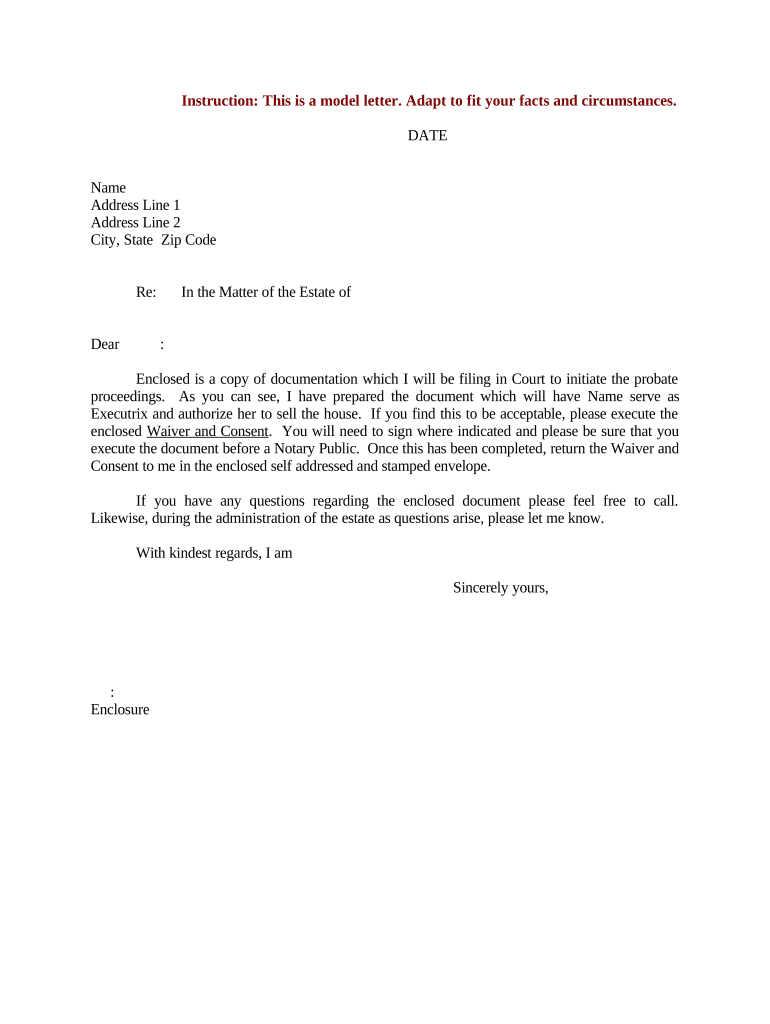

1. Header Information

Begin the letter with essential contact information. This includes the executor’s or administrator’s name, address, phone number, and email address. It’s crucial to provide accurate contact details to ensure prompt communication. The letter should also include the date of the valuation.

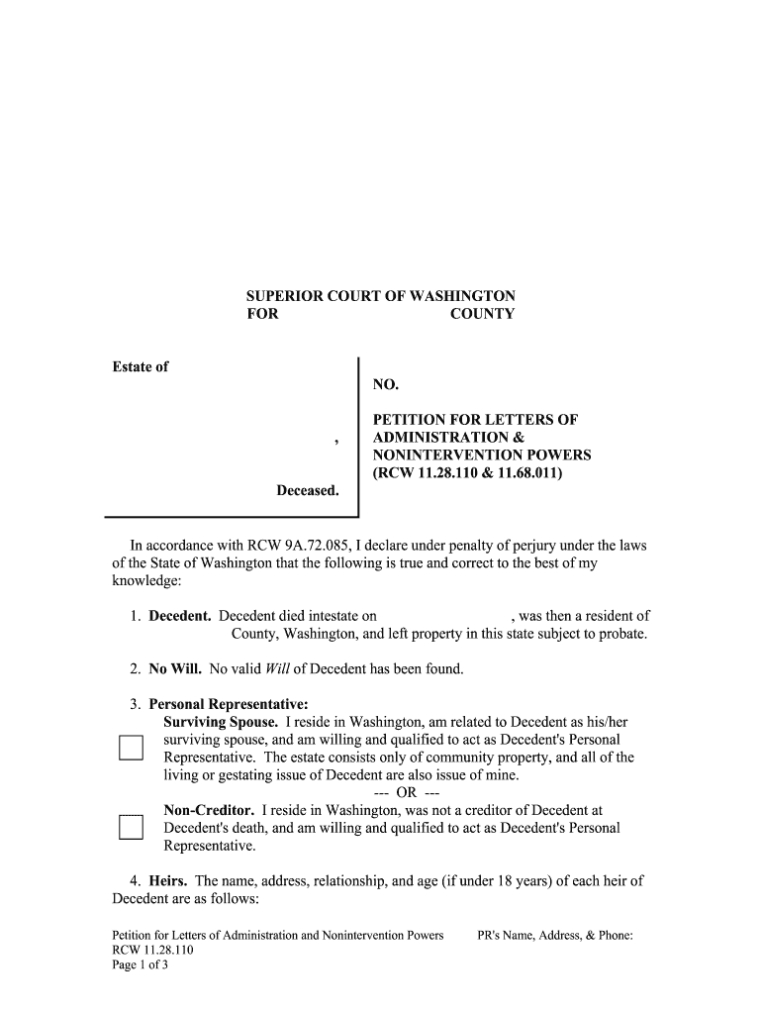

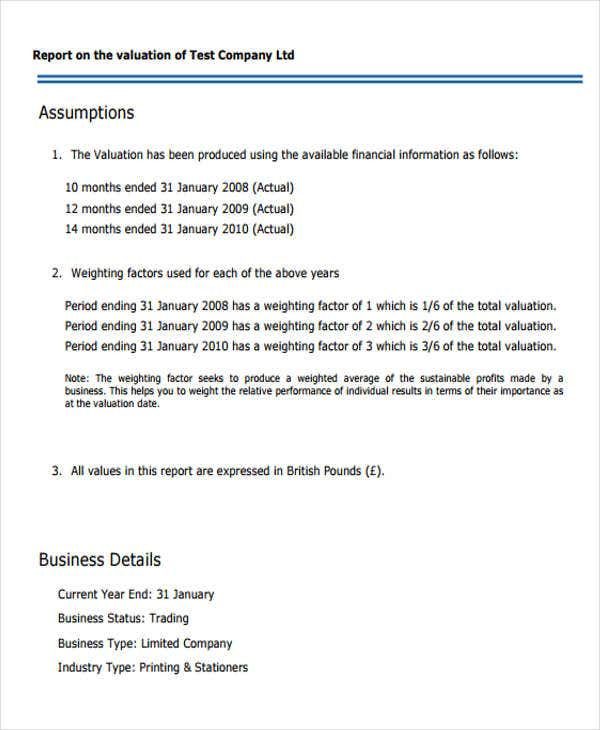

2. Estate Information

Clearly state the name of the deceased and the date of death. Provide the legal description of the estate, including the property address. This is vital for accurate identification and record-keeping.

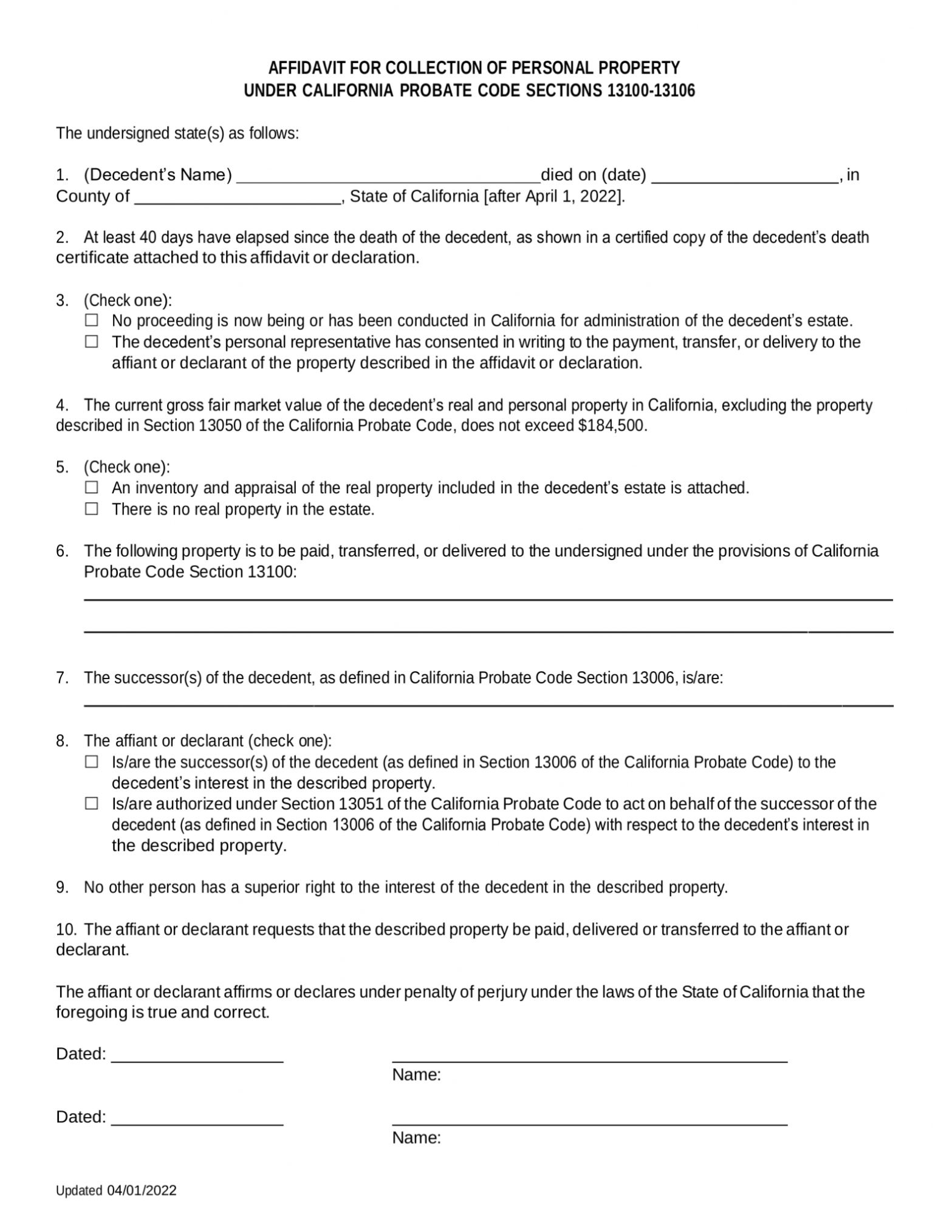

3. Asset Description

This section details the assets included in the estate. Be specific and provide a clear description of each asset, including its estimated value. Examples include real estate, bank accounts, stocks, bonds, personal property (vehicles, jewelry, etc.), and any other assets. Categorizing assets can also be helpful for clarity.

4. Appraisal Methodology

Explain the appraisal methodology used to determine the value of each asset. This demonstrates the thoroughness of the valuation process. Mention the name of the appraiser and the date of the appraisal. If multiple appraisals were conducted, clearly state the results and any discrepancies.

5. Valuation Calculations

This is the core of the letter. Provide a detailed breakdown of the calculations used to arrive at the estimated value of each asset. Clearly state the methods employed (e.g., market value, income capitalization, cost approach). Include supporting documentation, such as appraisal reports and market data. For example, you might state: “Based on comparable sales in the [Neighborhood] area, the value of the property is estimated at $XXX,XXX.”

6. Professional Opinion

Include a statement from the appraiser expressing their opinion on the value of the estate. This adds credibility to the valuation. The statement should clearly state the basis for their opinion and any potential limitations. For instance: “Based on the appraisal conducted by [Appraiser Name], the estimated value of the estate is $XXX,XXX.”

7. Conclusion and Recommendation

Summarize the valuation and provide a clear recommendation. This might include a statement that the valuation is “reasonable” or “consistent with market conditions.” You can also recommend further investigation or clarification if needed. For example: “We recommend further investigation into the condition of the property to ensure accurate valuation.”

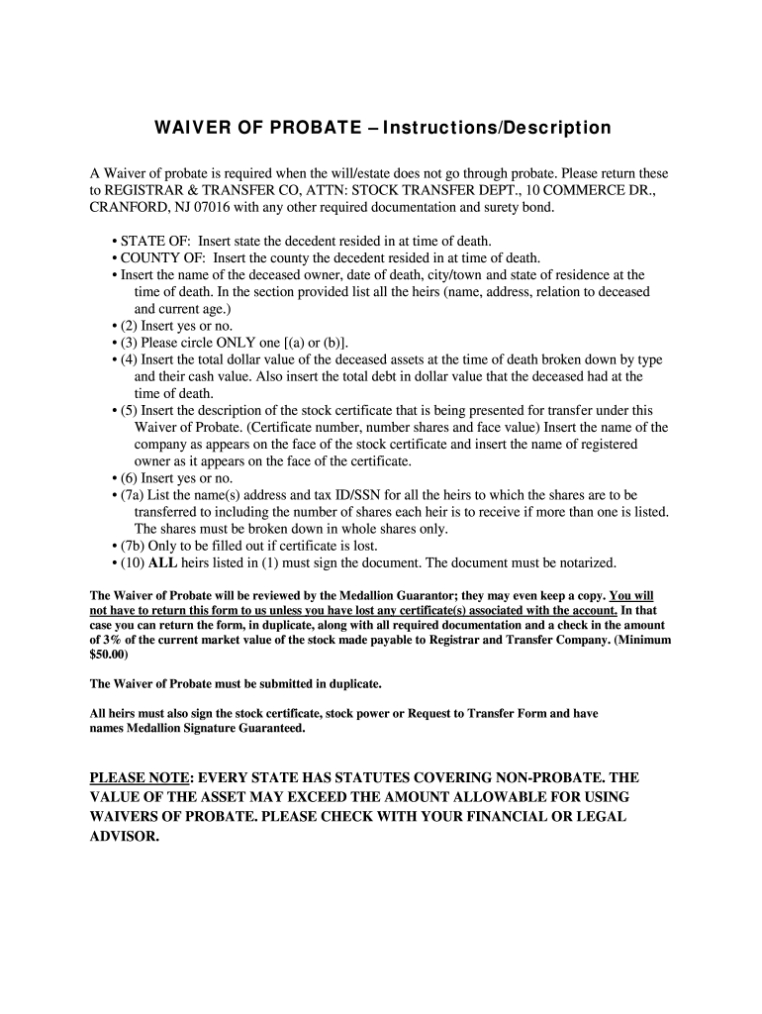

Variations and Customization

While the core components remain consistent, there’s room for customization. The specific details you include will depend on the nature of the estate and the requirements of the probate process. For example, if the estate includes significant business interests, you may need to include information about the business’s value. Consider adding a section for potential tax implications, outlining how the valuation will affect tax filings. It’s always advisable to consult with a qualified estate professional to ensure the Valuation Letter is properly prepared and meets all legal requirements.

Importance of Accuracy and Transparency

The accuracy of the Probate Valuation Letter is paramount. Any discrepancies or omissions can lead to delays, disputes, and potential legal challenges. Transparency is key; provide clear and concise information, and be prepared to answer questions from the probate court or other interested parties. Failure to provide a complete and accurate Valuation Letter can significantly jeopardize the estate’s probate process.

Beyond the Template: Additional Considerations

While the template provides a solid foundation, remember that a successful Valuation Letter is more than just a document. It’s a strategic tool that demonstrates due diligence and provides a clear record of the estate’s value. Consider these additional factors:

- Appraiser Credentials: Ensure the appraiser is properly licensed and qualified.

- Market Research: Conduct thorough market research to support the valuation.

- Legal Review: Have the Valuation Letter reviewed by an attorney to ensure compliance with legal requirements.

- Documentation: Maintain thorough documentation of all appraisals and supporting materials.

Conclusion

A well-crafted Probate Valuation Letter Template is an indispensable tool for navigating the probate process. By providing a clear, accurate, and detailed assessment of the estate’s assets, this document can significantly streamline the process, protect your interests, and ensure a smooth and legally sound outcome. Investing the time and effort to create a professional and comprehensive Valuation Letter is a worthwhile investment for any estate. Remember to always consult with qualified professionals to ensure compliance with all applicable laws and regulations. The key to a successful probate is a solid, well-documented valuation.

Conclusion

The Probate Valuation Letter Template is a critical component of the probate process, providing a reliable estimate of the estate’s value and facilitating efficient administration. By understanding the purpose, components, and best practices for creating this document, you can significantly improve your chances of a successful and legally sound outcome. Proper preparation and attention to detail are essential for ensuring compliance and minimizing potential complications. Ultimately, a clear and accurate Valuation Letter is a cornerstone of a well-managed probate.