Creating a smooth and efficient real estate transaction often begins with a well-crafted Letter of Intent (LOI). This document serves as a crucial initial step, outlining the buyer’s intentions and providing a framework for negotiations. It’s more than just a preliminary agreement; it’s a roadmap for a successful deal. A comprehensive and legally sound LOI is essential for protecting both the buyer and seller, minimizing potential disputes, and setting the stage for a collaborative partnership. This article will delve into the key components of a robust LOI, providing practical guidance and best practices for crafting a document that maximizes its effectiveness. Understanding the nuances of an LOI is vital for anyone involved in buying or selling a property. It’s a foundational document that can significantly impact the final outcome of the transaction.

The process of creating an LOI can seem daunting, but breaking it down into manageable steps makes it achievable. It’s a conversation, not a rigid contract. The goal is to clearly define the terms and expectations, allowing both parties to move forward with confidence. A poorly drafted LOI can lead to misunderstandings and delays, while a well-structured one can prevent costly disagreements down the line. Consider this LOI a starting point – it’s a template to be adapted to your specific circumstances.

Understanding the Purpose of a Letter of Intent

The primary purpose of a Letter of Intent (LOI) is to signal the buyer’s serious interest in purchasing a property. It’s a non-binding agreement, meaning it doesn’t legally obligate either party to proceed with the purchase until a formal purchase agreement is executed. However, it’s a critical document that establishes a baseline for negotiations, clarifies key terms, and demonstrates the buyer’s commitment. Sellers often use LOIs to gauge potential buyers, secure financing, and begin the process of preparing for a formal contract. It’s a powerful tool for building trust and establishing a preliminary understanding. The LOI allows the seller to assess the market value, identify potential buyers, and plan their strategy.

Key Components of a Strong Letter of Intent

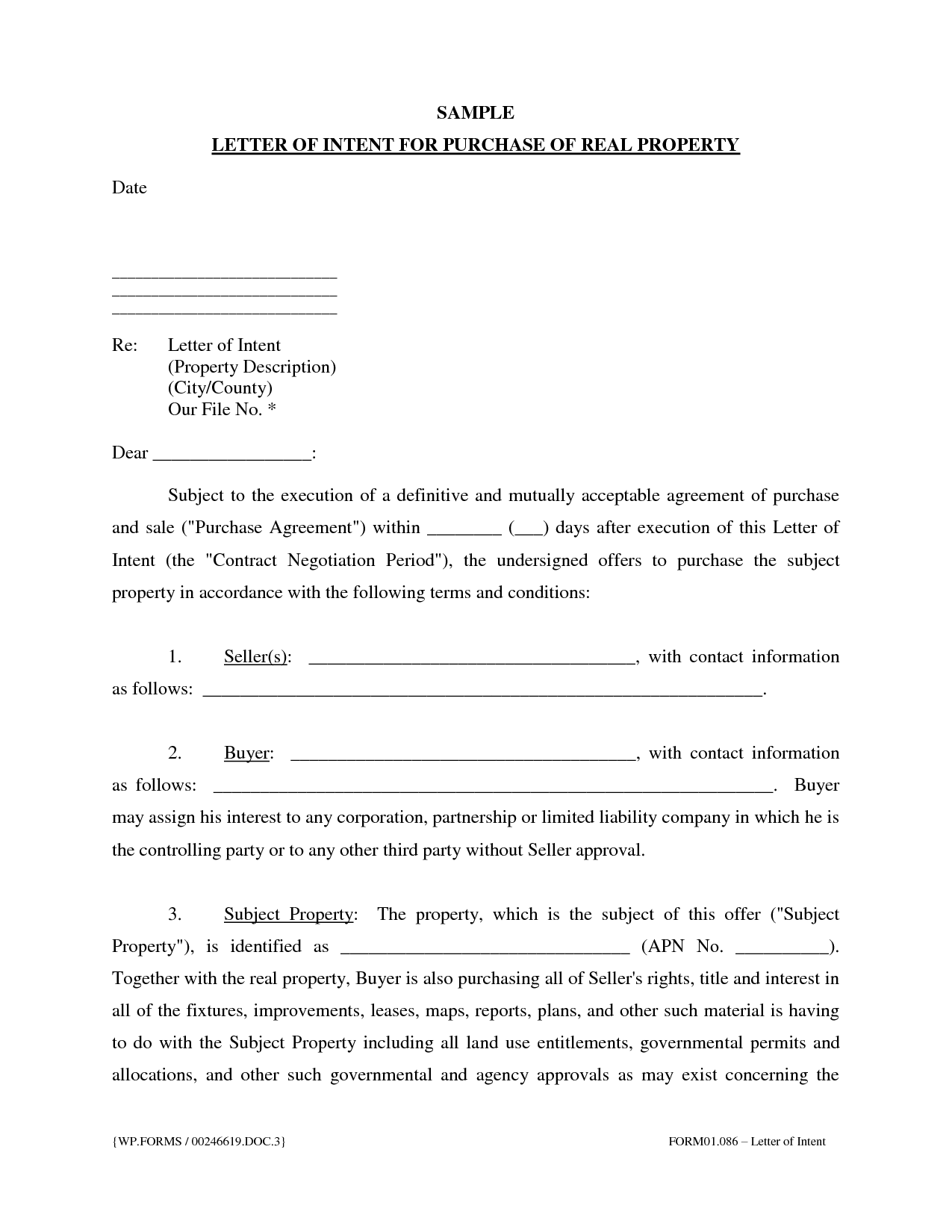

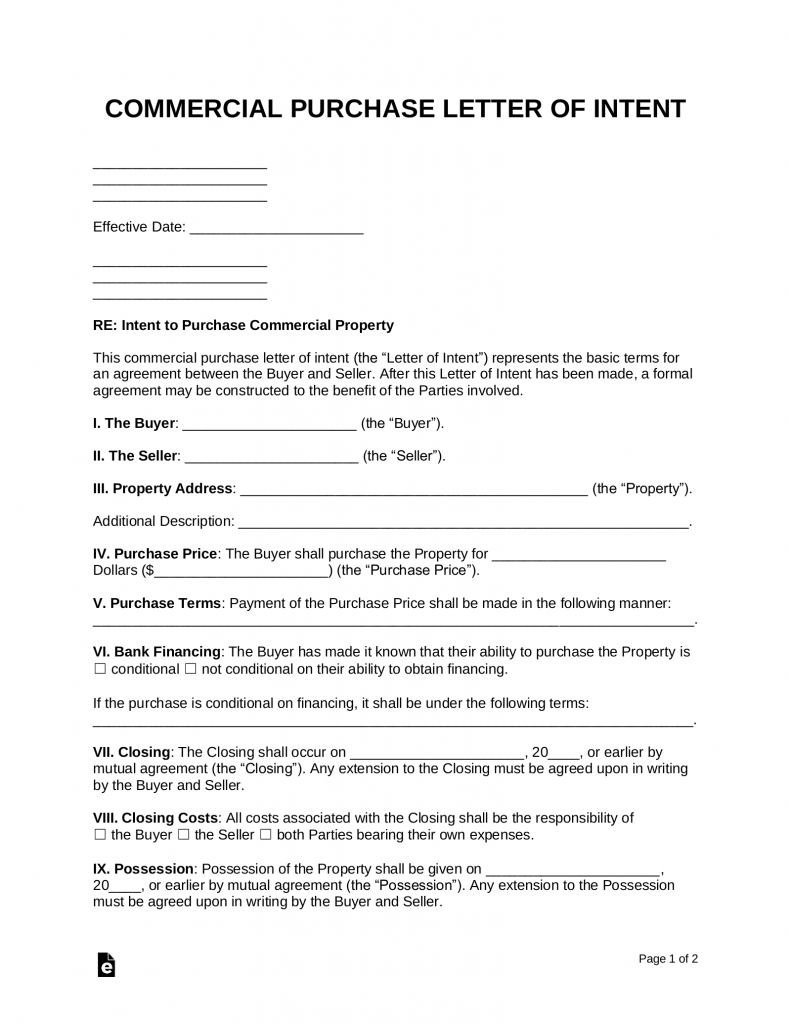

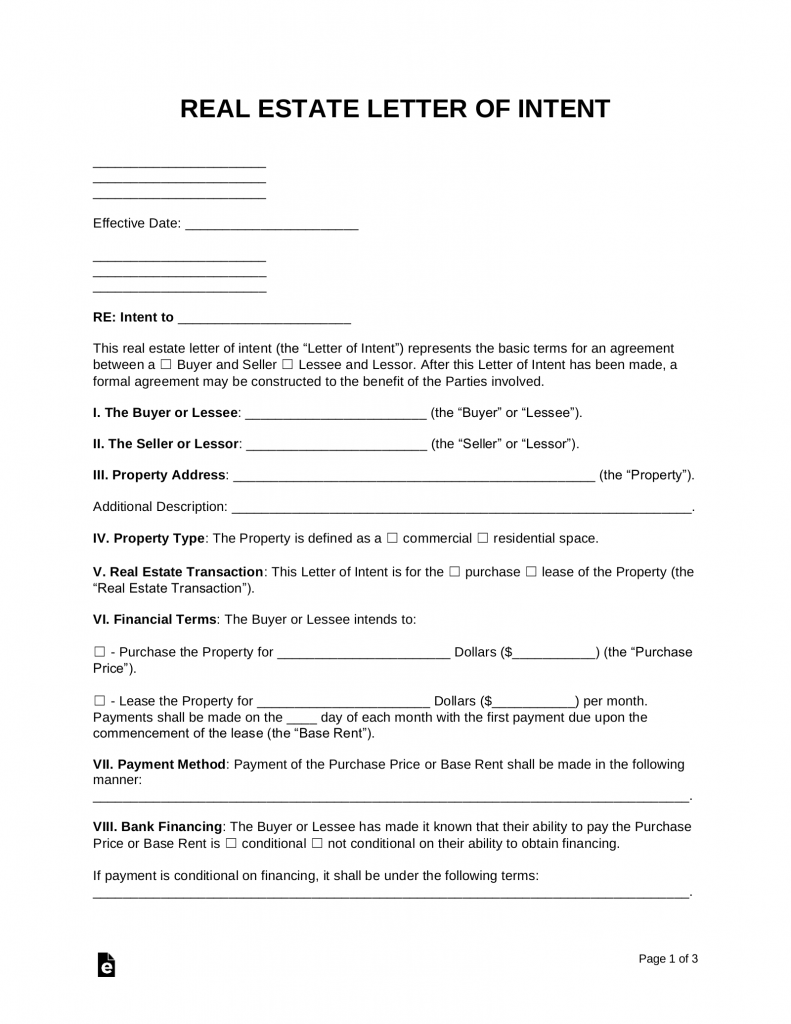

A successful LOI typically includes the following elements:

- Identification of Parties: Clearly state the names and contact information of both the buyer and seller.

- Property Description: Provide a detailed description of the property being offered, including address, acreage, and any relevant features.

- Purchase Price: Outline the proposed purchase price, including any contingencies (e.g., financing, inspection).

- Earnest Money Deposit: Specify the amount and conditions for the earnest money deposit.

- Due Diligence Period: Define the timeframe for the buyer to conduct due diligence (e.g., inspections, appraisals).

- Closing Date: Establish a proposed closing date, ideally with a reasonable timeframe.

- Contingencies: List any contingencies that the buyer requires to proceed with the purchase (e.g., financing approval, satisfactory inspection reports).

- Non-Binding Nature: Explicitly state that the LOI is non-binding, except for specific provisions outlined below.

The Importance of “Letter Of Intent For Real Estate Purchase Template”

The phrase “Letter of Intent For Real Estate Purchase Template” is strategically included within the introduction. It’s not merely a filler; it’s a deliberate inclusion to signal the topic of the document. It subtly reinforces the core focus of the LOI – a standardized template for expressing intentions related to real estate transactions. It’s a way to immediately establish the document’s purpose and relevance to the reader. It’s a concise way to introduce the subject matter without overwhelming the reader with unnecessary detail.

The Role of Contingencies in an LOI

Contingencies are absolutely critical components of a well-crafted LOI. These provisions protect both the buyer and seller by addressing potential risks and uncertainties. Common contingencies include:

- Financing Contingency: Ensures the buyer has secured financing before proceeding with the purchase.

- Inspection Contingency: Allows the buyer to conduct inspections and potentially terminate the agreement if significant issues are discovered.

- Appraisal Contingency: Protects the buyer if the property’s appraised value falls below the purchase price.

- Title Contingency: Ensures the seller has a clear title to the property and that there are no outstanding liens or encumbrances.

The specific contingencies included in the LOI should be tailored to the individual transaction and the risks involved. A thorough review of the title and legal aspects of the property is essential before finalizing the LOI.

Negotiating the Terms of an LOI

The LOI is not a contract; it’s a starting point for negotiation. Both parties should be prepared to discuss and adjust the terms to reach a mutually agreeable agreement. Common areas of negotiation include:

- Purchase Price: The initial price offered and any adjustments.

- Earnest Money Deposit: The amount and conditions for the deposit.

- Closing Date: The agreed-upon closing date.

- Contingencies: The specific conditions that must be met for the purchase to proceed.

- Escrow: The arrangement for holding funds and documents during the transaction.

It’s crucial to have a clear understanding of each party’s priorities and to be willing to compromise. Legal counsel should be consulted to ensure that the LOI accurately reflects the intentions of both parties and protects their interests.

Beyond the Initial LOI: Formalizing the Agreement

While the LOI serves as a valuable initial step, it’s often followed by a more formal purchase agreement. This agreement, typically drafted by an attorney, incorporates all the terms and conditions outlined in the LOI and provides a legally binding contract. The purchase agreement will detail all aspects of the transaction, including the purchase price, closing date, contingencies, and other important provisions. It’s important to have both the LOI and the purchase agreement reviewed by an attorney to ensure that they are consistent and protect your interests.

The Importance of Legal Review

Given the significant financial implications of a real estate transaction, it is absolutely essential to have the LOI and purchase agreement reviewed by a qualified real estate attorney before signing. An attorney can identify potential risks, ensure that the documents are legally sound, and protect your interests. They can also advise you on the best course of action and negotiate favorable terms on your behalf.

Conclusion

A well-crafted Letter of Intent for Real Estate Purchase Template is a cornerstone of a successful real estate transaction. It’s a vital tool for establishing a clear understanding of the buyer’s intentions, protecting both parties’ interests, and facilitating negotiations. By understanding the key components of an LOI, carefully considering the terms, and seeking legal advice, you can significantly increase your chances of a smooth and rewarding real estate experience. Remember that the LOI is a starting point – it’s a conversation that evolves into a formal, legally binding agreement. Investing the time and effort to create a robust LOI is a worthwhile investment that can save you time, money, and potential headaches in the long run.