Creating professional invoices is a cornerstone of any business, whether you’re a freelancer, a small business owner, or a larger enterprise. A well-designed invoice ensures clear communication with your clients, streamlines payment processing, and ultimately, strengthens your financial relationships. This guide will walk you through the essential steps and elements of creating effective invoice templates, ensuring your invoices are both visually appealing and functionally sound. How To Write A Invoice Template is more than just a template; it’s a strategic tool for managing your finances and building a solid business foundation. Let’s dive in.

Understanding the Importance of Invoice Templates

Before we begin, it’s crucial to understand why invoice templates are so valuable. They’re not just about aesthetics; they’re about efficiency and professionalism. A consistent, well-formatted invoice demonstrates attention to detail, builds trust with your clients, and reduces the risk of misunderstandings regarding payment terms. Poorly designed invoices can lead to delays, disputes, and a damaged reputation. Investing time in creating a professional template is an investment in your business’s success. Think of it as setting the stage for a smooth and positive financial exchange.

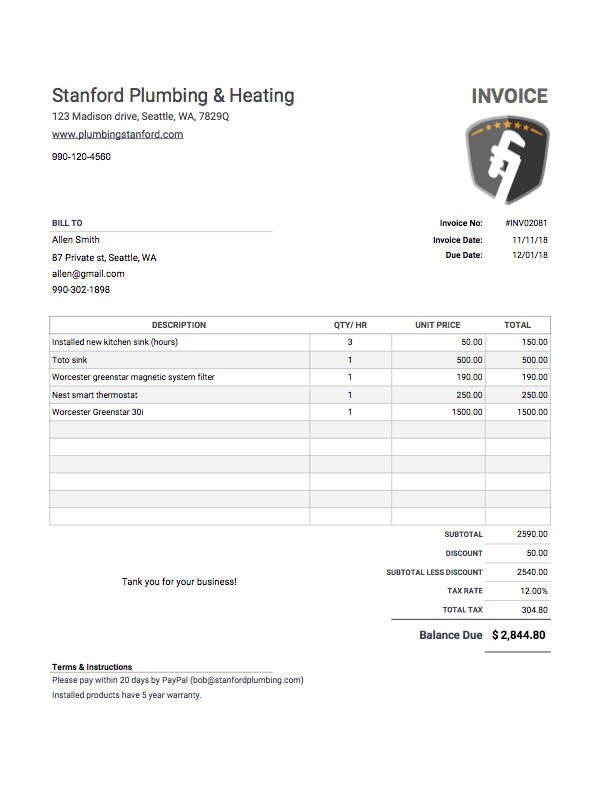

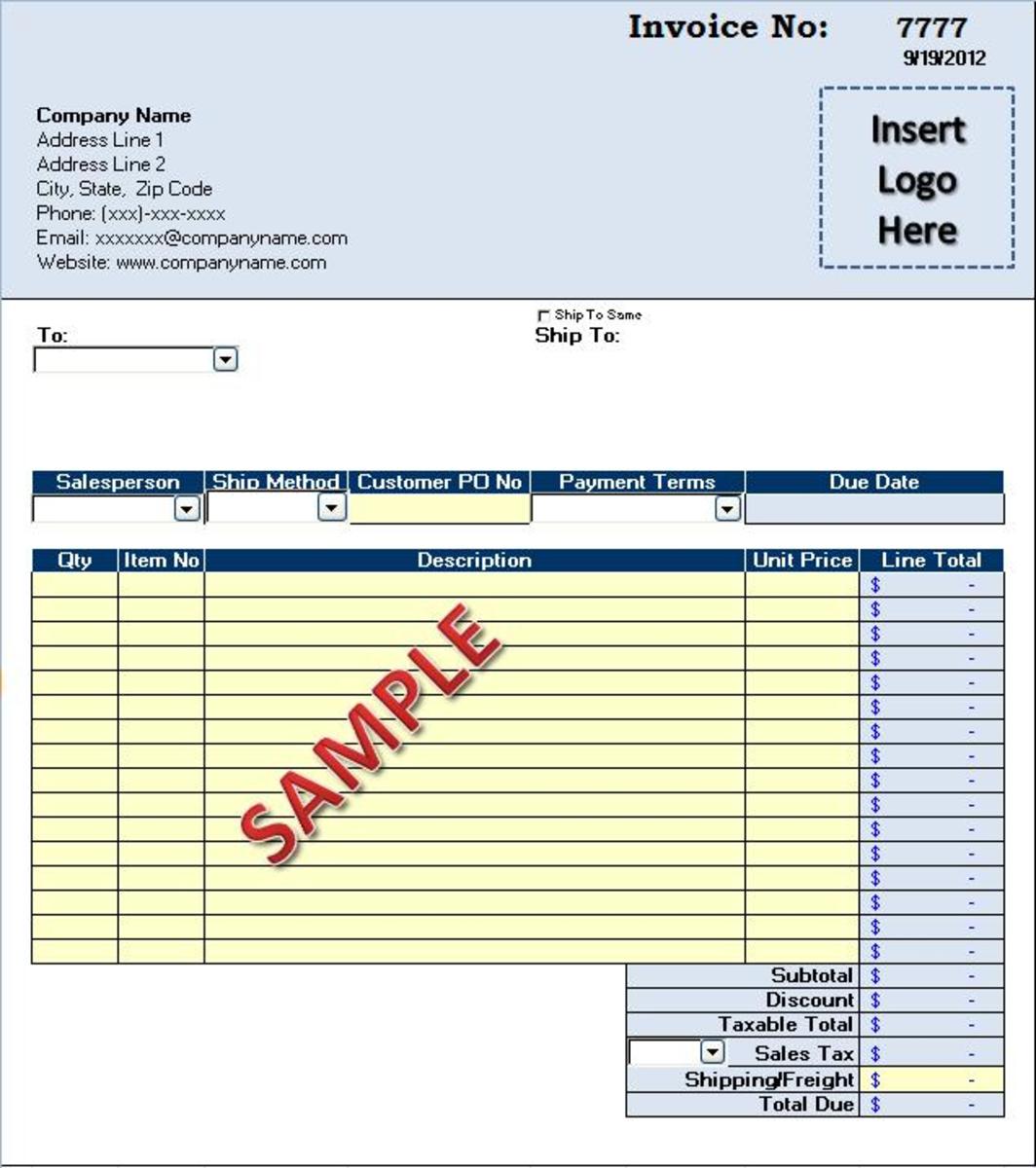

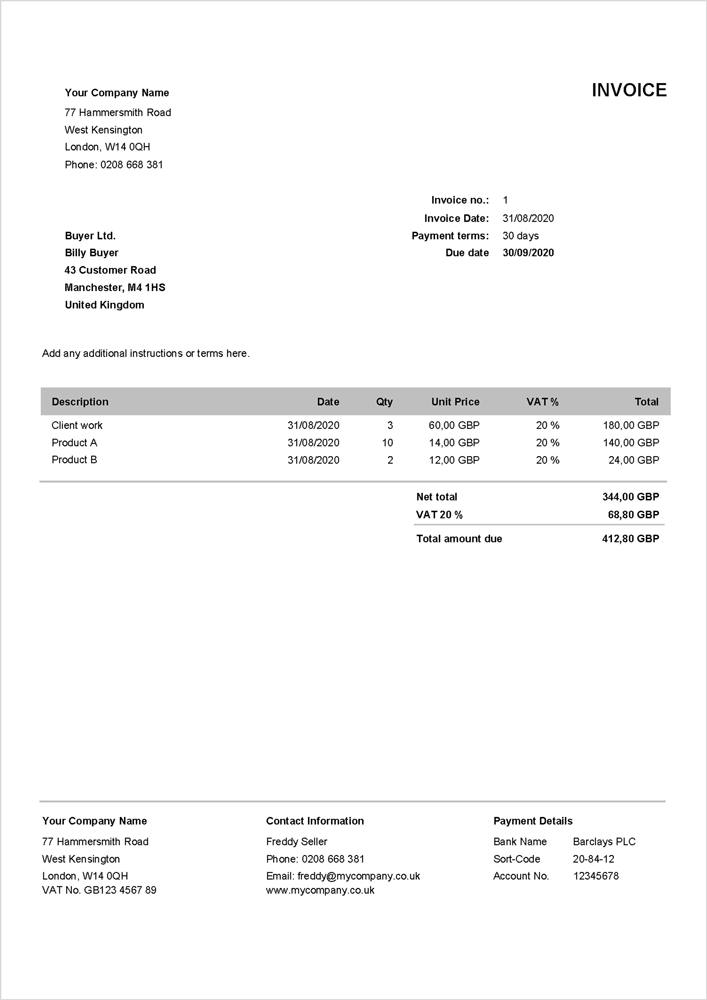

Core Components of a Professional Invoice

A truly effective invoice template should include several key elements. These elements work together to provide all the necessary information for a seamless transaction. Let’s break down the essential components:

- Company Information: Clearly display your business name, address, and contact details. This helps clients easily identify you and contact you with questions.

- Client Information: Include the client’s name, address, and contact information. This is vital for tracking payments and resolving any issues.

- Invoice Number: Assign a unique invoice number to each invoice. This is crucial for tracking and referencing invoices. Using sequential numbers is highly recommended.

- Invoice Date: Record the date the invoice was issued.

- Due Date: Specify the date by which payment is expected. Setting clear expectations upfront prevents late payments and potential disputes.

- Description of Services/Products: Provide a detailed description of the goods or services provided. Be specific – avoid vague terms.

- Quantity/Rate: Clearly state the quantity of goods or services provided and the corresponding rate.

- Total Amount Due: Calculate and display the total amount due, including any taxes or fees.

- Payment Terms: Outline your payment terms – e.g., Net 30, due upon receipt, etc.

- Payment Methods: Specify accepted payment methods (e.g., bank transfer, credit card, PayPal).

Building Your Invoice Template: A Step-by-Step Guide

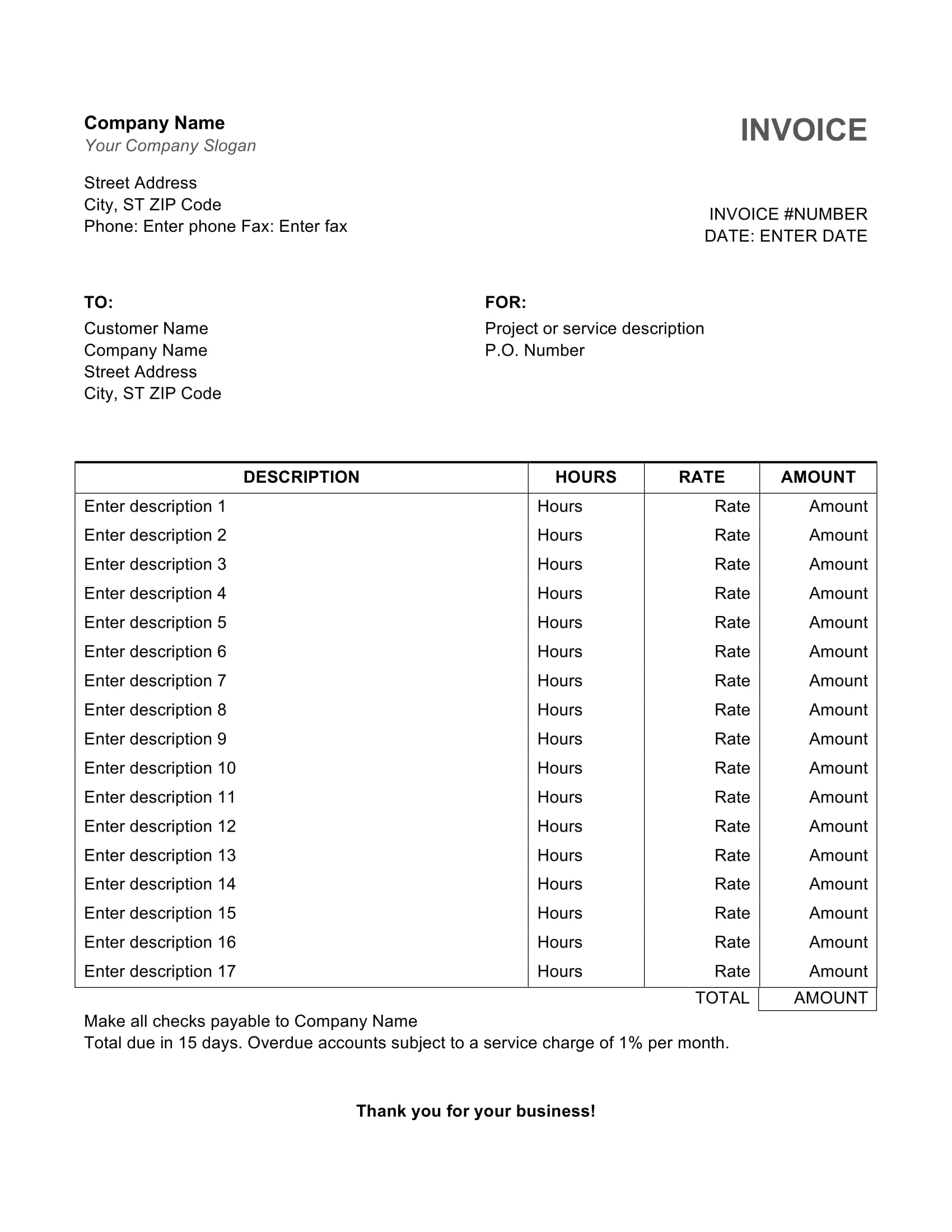

Now, let’s look at how to build a robust invoice template. It’s important to tailor the template to your specific business needs and industry. Here’s a breakdown of the process:

- Choose a Template Format: Select a format that suits your needs – Word, Google Docs, or a dedicated invoice template software. Google Docs offers a free, collaborative option.

- Start with a Basic Structure: Begin with a simple layout, focusing on the core components listed above. Don’t overcomplicate it initially.

- Customize for Each Invoice: The most important step! Each invoice should be tailored to the specific client and the services/products provided. Don’t use a generic template without modification.

- Use Clear and Concise Language: Avoid jargon and overly complex wording. Keep the language straightforward and easy to understand.

- Include Relevant Images (Optional): Consider adding a small logo or a relevant image to enhance the invoice’s visual appeal. Ensure images are high-resolution and properly sized.

- Proofread Carefully: Before sending any invoice, meticulously proofread it for any errors in spelling, grammar, or calculations. Errors can damage your credibility.

Sub-Section 1: Detailed Invoice Components Explained

Let’s delve deeper into some of the key components and how to make them more effective:

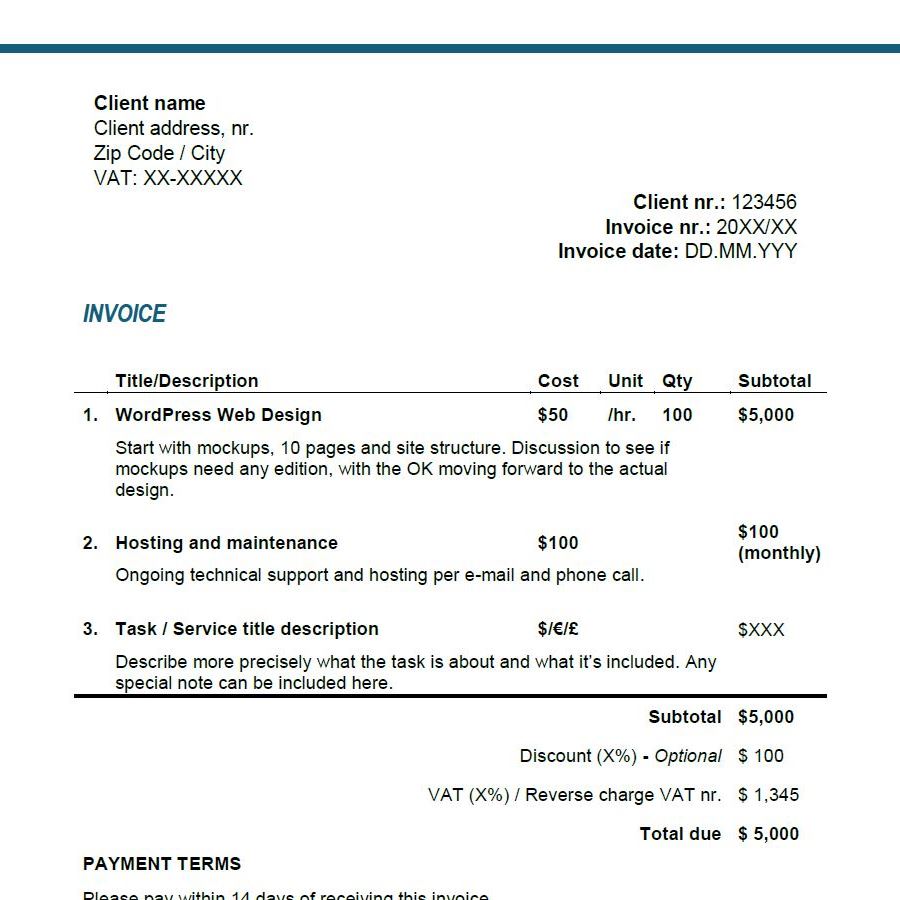

The Description Section: Specificity is Key

The description section is where you provide the specific details of what you’re billing for. Avoid vague descriptions like “marketing services.” Instead, be precise: “Social Media Marketing Campaign – Facebook & Instagram Ads – 3 Months” or “Graphic Design Services – Logo Design – 5 Pages.” This level of detail helps clients understand exactly what they’re paying for. Consider adding a brief explanation of the services provided.

The Payment Terms Section: Transparency Builds Trust

Clearly state your payment terms. “Net 30” means payment is due 30 days after the invoice date. “Due upon receipt” means payment is expected when the invoice is received. Be upfront about your payment policies. A clear payment terms section minimizes disputes.

The Tax Information Section: Don’t Forget Taxes!

Many jurisdictions require you to include tax information on your invoices. Specify the applicable tax rate and the amount of tax due. This is particularly important for businesses operating in multiple states or countries.

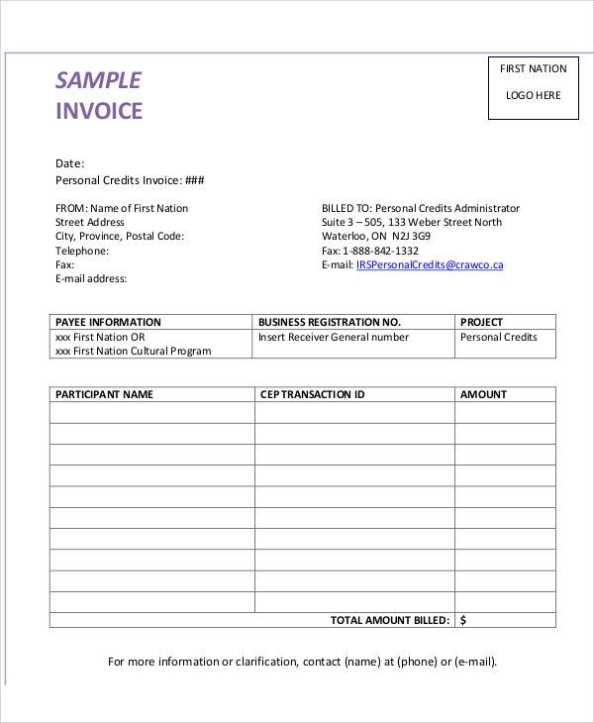

Sub-Section 2: Invoice Design Best Practices

The visual appeal of your invoice significantly impacts its effectiveness. Here are some design best practices:

Color Palette: Maintain Consistency

Use a consistent color palette throughout your invoice. A simple, professional color scheme is often best. Avoid overly bright or distracting colors.

Font Choice: Choose Readable Fonts

Select fonts that are easy to read. Sans-serif fonts like Arial or Helvetica are generally preferred for invoices. Use a consistent font size throughout the document.

Whitespace: Don’t Overcrowd

Leave sufficient whitespace around the text and images to improve readability. Avoid cramming too much information onto the page.

Professional Formatting: Maintain a Clean Look

Ensure your invoice is well-formatted and free of errors. Use consistent spacing and alignment.

Sub-Section 3: Invoice Software and Tools

Several software options can streamline the invoice creation process:

- Wave Accounting: A free option for basic invoicing and accounting.

- Zoho Invoice: A user-friendly and affordable option with a range of features.

- QuickBooks Online: A comprehensive accounting software with robust invoicing capabilities.

- Invoice Ninja: A popular choice for freelancers and small businesses.

Conclusion: The Power of a Well-Crafted Invoice

Creating a professional invoice template is a vital investment for any business. It’s more than just a document; it’s a tool for managing finances, building trust, and streamlining your business operations. By following the steps outlined in this guide, you can create invoices that are both effective and visually appealing. Remember to consistently review and update your templates to ensure they remain relevant and efficient. Investing the time to create a solid invoice template will undoubtedly pay dividends in the long run. Ultimately, a well-crafted invoice is a cornerstone of successful business practices.

Conclusion

In conclusion, investing in a well-designed invoice template is a strategic move that can significantly benefit your business. By focusing on clarity, professionalism, and efficiency, you can create invoices that streamline your financial processes, build trust with your clients, and contribute to your overall success. Don’t underestimate the power of a thoughtfully crafted invoice – it’s a fundamental element of effective business communication.