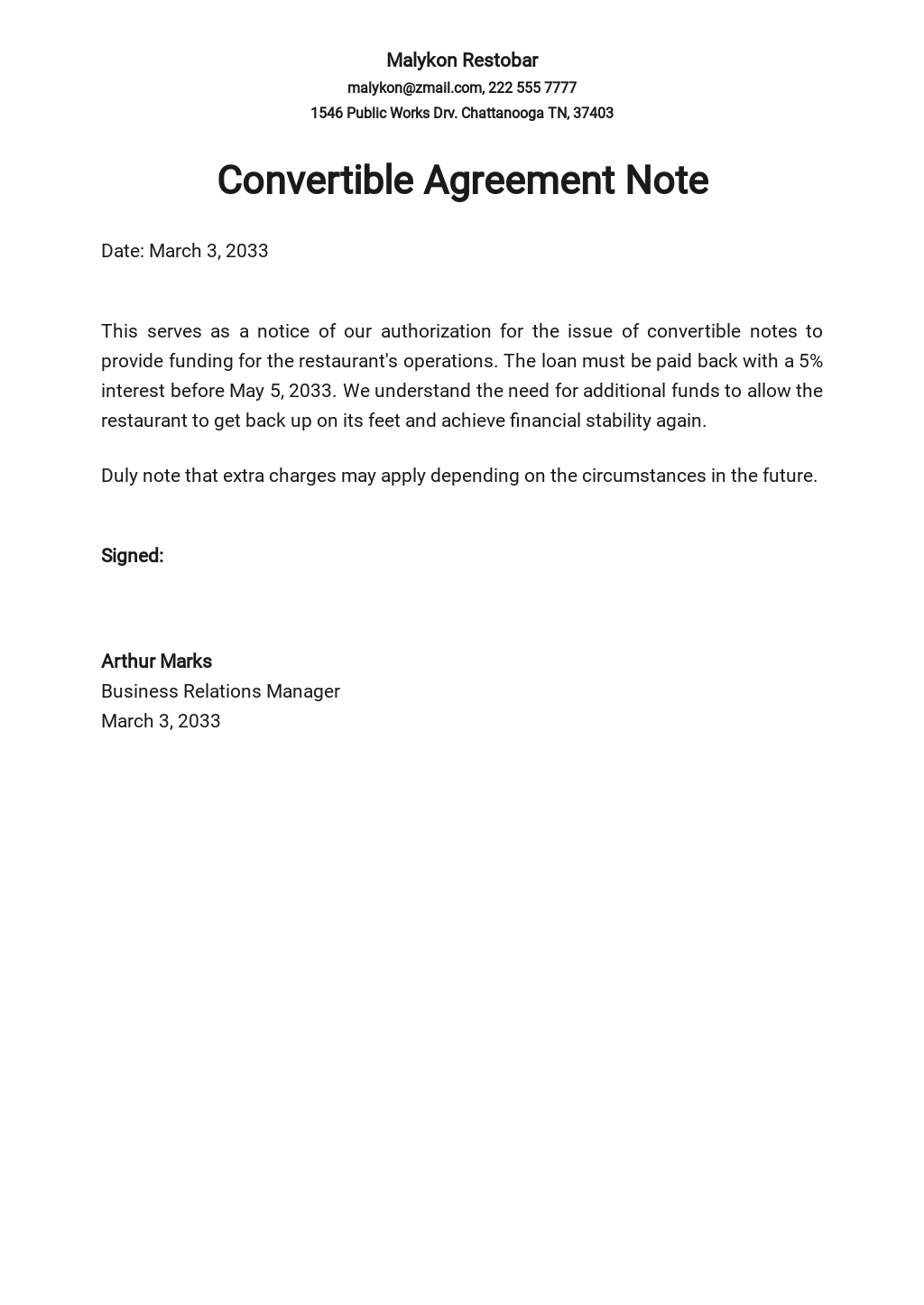

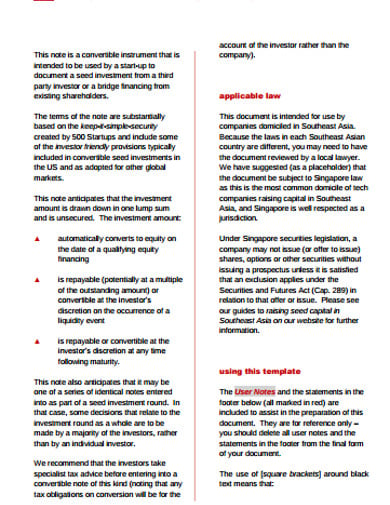

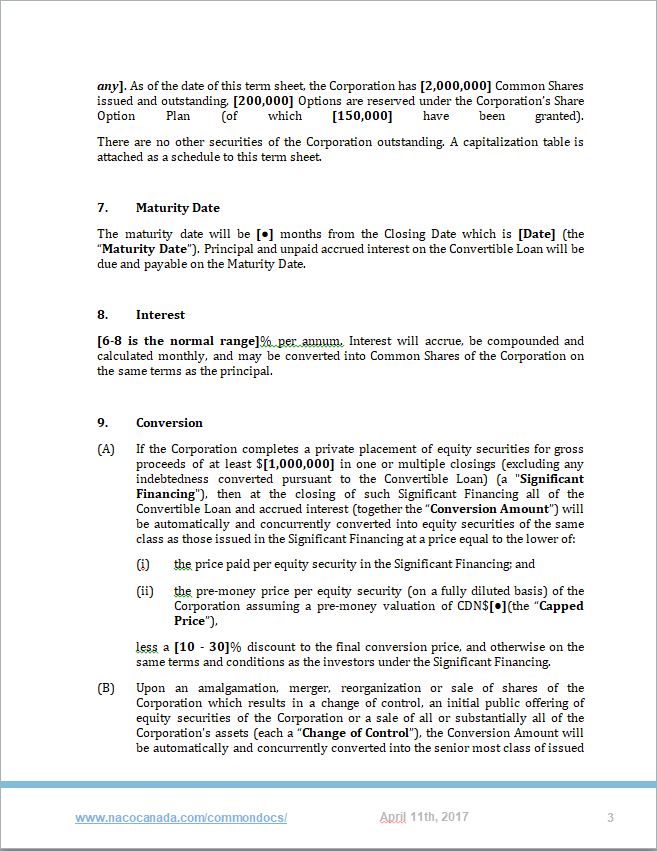

Convertible Loan Note Template. High-growth start-ups or more mature businesses on the lookout for upfront cash ahead of a future funding round, and needing more safety than an ASA. SAFE was created by the startup accelerator Y-Combinator as a method to make seed investing simpler and simpler. Just like convertible loans, worker inventory choices are only considered to be dilutive when they are “in the money” — that is, when the conversion price is less than the present value of the inventory after dilution. However, the above is simply one of the attainable conversion situations.

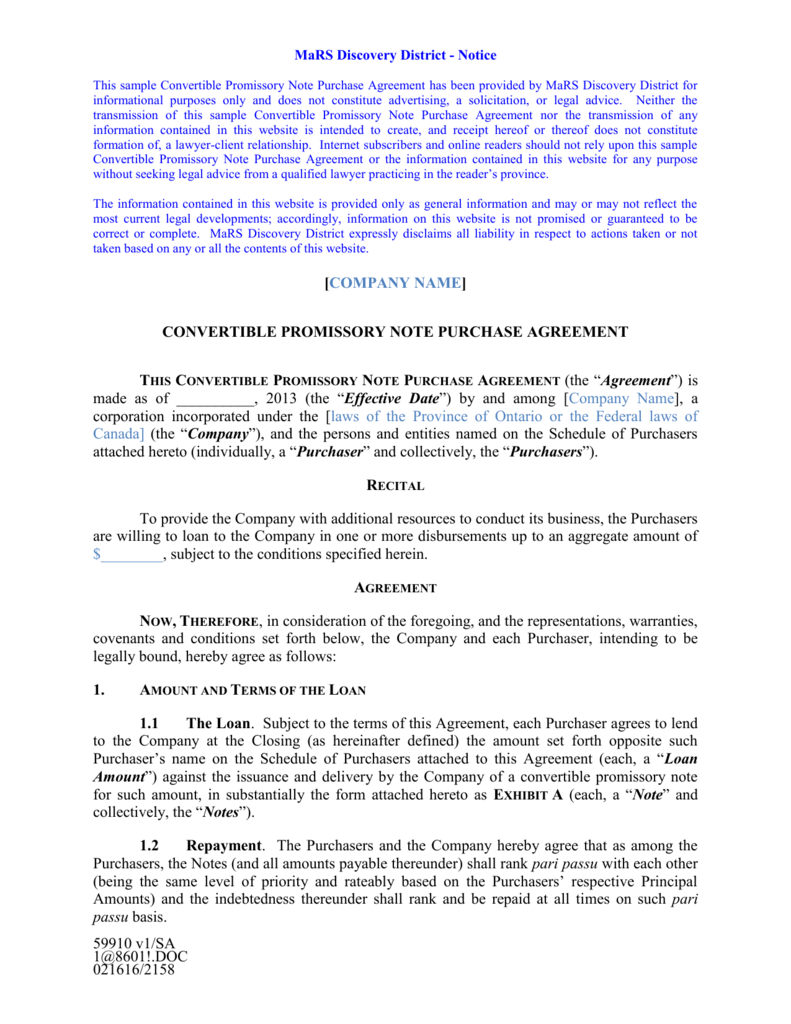

Once a valuation is about after a Series A round of funding, those unique notes are transformed to fairness at a discounted value. Most notes have a provision for when a startup is purchased out. Before understanding the idea of a convertible note term sheet right here is an natural progression of the documents which might be exchanged in the startup fundraising course of utilizing Notes.

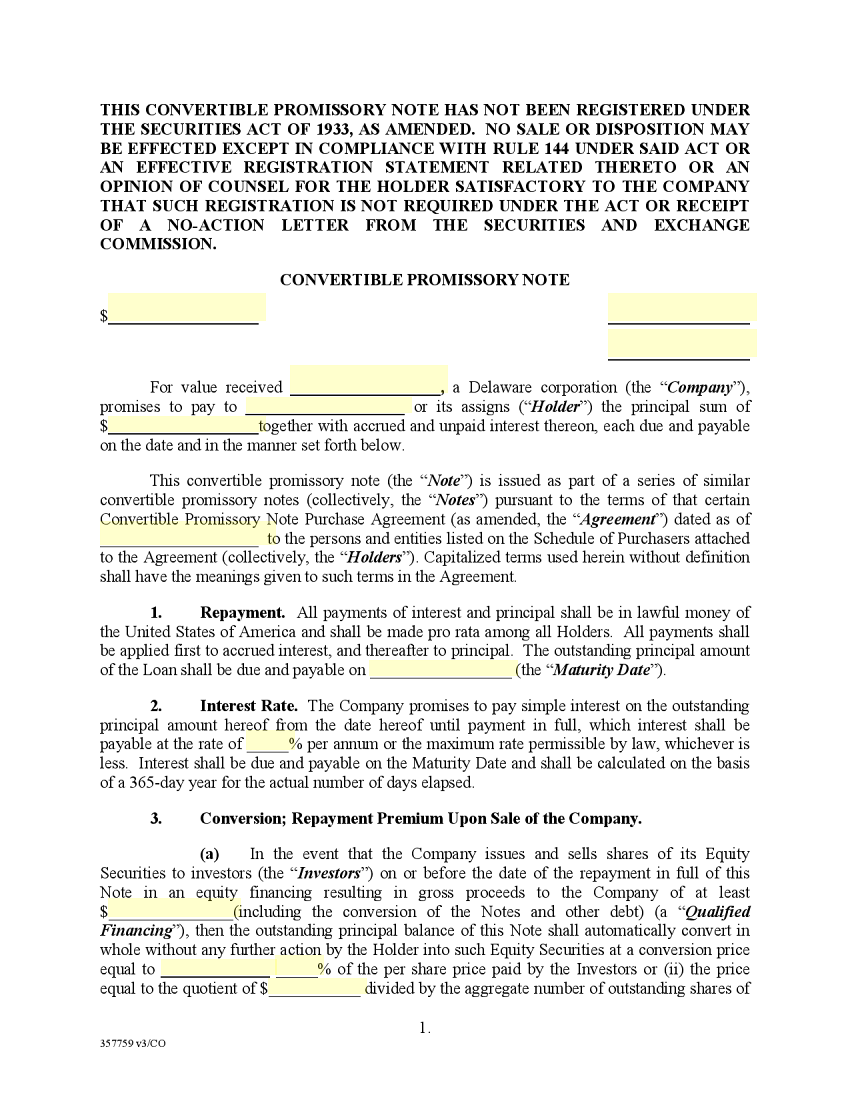

This protects the noteholder investor from “missing out” ought to the company’s worth spike after the CLN is agreed. Also, convertible notes sometimes set off only when a “qualifying transaction takes place” or when each parties agree on the conversion. Secured Promissory Note – Requires the Borrower to position property or property in the Note which is simply given to the Lender within the occasion of non-payment. Despite estimations and due diligence, generally startups fail, and investors lose all their money. This is similar to a Stock Purchase Agreement and the underlying Stock Certificate which symbolizes the really inventory held by the purchaser.

It shouldn’t be essential to say securities legending and different securities law affirmative obligations within the term sheet, as the events don’t have any selection but to adjust to those in the last documentation and efficiency. Each time the enterprise seeks outdoors funding or increases the dimensions of the options pool the founders are diluted and the share of the business they personal decreased.

The granting of inventory options to key personnel is a method of compensating them for offering their services and usually creates an expense for the enterprise. The expense is the variety of choices granted multiplied by the fair value of every option on the date of grant, and is included in the monetary projections template income statement as an expense allotted over the vesting period of the choices.

Convertible Observe Calculator

This only matters when the time period is longer than a yr, however in any other case doesn’t matter for a short‐term funding. Interest accrual is beneficial for buyers for the plain financial incentives, however it creates an incentive for the founder to get an equity round accomplished sooner quite than later. It’s nonetheless a low-cost mortgage, so again who cares- you need the money.

As a part of the unique deal when an investor points a convertible note to a startup, there shall be a set discount price. While the quantity of the discount varies from deal to deal, it’s usually between 15 and 25 % and it rewards early investors.

Gls’s Ultimate Information To Authorized Operations

If Britain imported greater than it exported to such nations, recipients of kilos sterling inside these nations tended to place them into London banks. This meant that although Britain was running a commerce deficit, it had a financial account surplus, and funds balanced.

If a “Weekly” payment schedule will be followed by the Borrower, then the mark the checkbox labeled “Weekly” and supply when the date when the ultimate mortgage cost required shall be expected. Record the ultimate date when the on time lump sum cost must be submitted to the Lender by the Borrower.

Observe Convertible Notes With Diligent Equity

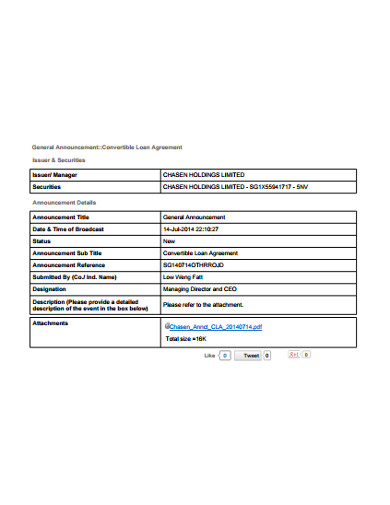

These conversion occasions might include, the start of a qualifying funding round or it could be in the occasion of a company sale. However, the advantages of conversion and changing into a shareholder will rely totally on the expansion of the corporate and will also depend upon the rights attaching to the shares into which the CLN converts. Imagine a company, ABC Ltd., raised funds in the course of the seed round of financing, issuing convertible notes with the valuation cap worth $5,000,000 and no discount previous to the Series A round at a $15 pre-money valuation and $15 share worth.

It’s normally set at three or 5 years from the date of the settlement. Diversification is simply across a number of early-stage funding opportunities throughout the asset class.

Never earlier than had worldwide financial cooperation been tried on a everlasting institutional basis. Even more groundbreaking was the choice to allocate voting rights amongst governments, not on a one-state one-vote basis, but quite in proportion to quotas. Since the United States was contributing the most, U.S. management was the key.

No alms of steadiness shall be fabricated except by agency of a announcement affair the requirements of the Balance Act. Raise capital using our Pitch Summary that clearly outlines what investors wish to see. To effortlessly construct monetary forecasts and lift the capital they need.

Since the Notes will convert to equity, buyers will achieve 25,000 shares of the corporate at this milestone occasion. Though notes are a debt instrument, not like traditional loans that function on high-interest charges and common payback schedules, notes are seamless. Founders don’t have to pay again the principal quantity or accrued pursuits.

For example, the Tranche 2 shares exercised will lead to 460 new shares at a rate of $35. This provides the corporate with $16,one hundred that it instantly uses to purchase back 322 inventory ($16,100 / $50). The result’s that there are 138 net new shares for that tranche (460 – 322).

If there are convertible loans and other options that could turn out to be shares, then they would impact the EPS metric. Say your valuation prior to Series A financing is $2 million.

Many Lenders will expect an additional amount of money paid along with the original loan amount. Generally, this is calculated and applied as a share of the owed amount. The percentage to be used because the “Interest Rate” must be documented in Statement .

Once a valuation is ready after a Series A round of funding, those unique notes are converted to equity at a reduced value. Valuation cap – Convertible notes convert into fairness on maturity. Keeping this in mind, the valuation cap characteristic proposes a predetermined lower share price for use while converting the notes at maturity.

Since conversion would translate to fairness that has big upsides, the loan carries less risk for the lender. Convertible loans, thus, profit both the company and the lender. When the cap is low, the investor receives more equity if a startup turns into profitable.

The final important thing to hold in mind concerning the completely different knobs and levers of a convertible observe is the curiosity. The curiosity is ultimately probably the most safe way for buyers to earn cash and must be paid to traders in the form of the additional value of the stock. The typical curiosity varies from year to yr and may be wherever from 5 as a lot as 10%.

If the startup will get acquired prior to the maturity date — and earlier than qualified financing — the buyers will receive the percentage of capital outlined in this subject. Let’s get an outline of the core phrases you’d embody in a term sheet for a convertible note. That is, together with some key points that want your consideration when drafting your personal document.

Since 1964 numerous banks had fashioned international syndicates, and by 1971 over three-quarters of the world’s largest banks had become shareholders in such syndicates. Multinational banks can and do make massive worldwide transfers of capital not just for investment purposes but additionally for hedging and speculating towards change price fluctuations.

In flip, the IMF embarked on organising guidelines and procedures to keep a rustic from going too deeply into debt yr after year. The Fund would exercise “surveillance” over different economies for the united states Treasury in return for its loans to prop up national currencies.

On the convertible note’s maturity date, you pay the mortgage in full with amassed interest factored in. Convertible notes are principally utilized by startups as an preliminary stage funding when it’s not attainable to offer a proper company valuation.

CLNs are sometimes used by an Angel investor to offer capital to a enterprise at a really early stage of its development. The ‘convertible’ aspect of the note means the debt can be converted into equity within the firm, usually within the form of shares, at a selected future occasion, often a later spherical of funding. A convertible observe is debt that is finally either converted into fairness or is paid again to the investor.

But as a substitute of earning curiosity in dollars, the holder of a convertible notice earns interest within the form of more shares. The curiosity accrues till the startup has their Series A valuation, at which level it is converted into shares for the investor. But for convertible note issuances, if a high-risk startup performs properly, the post-conversion shares that the buyers now hold are value much more than the unique loan principal, serving as an additional incentive (i.e. reward for risk) for the investors.

The investor and the investee company will negotiate the ‘trigger’ for the conversion of the mortgage notes into shares. This will usually be either an agreed date or a qualifying round of fairness funding. Note that additional triggers would include default, change of management and the sale or liquidation of the corporate.

When these situations are applied, convertible notice calculations can turn into complex. It is finest to use an automatic calculator to arrive at a believable worth or consult professionals for a similar. Our business lawyers are based mostly in or near main cities across the UK, providing skilled legal recommendation to shoppers each regionally and nationally.

The favourable phrases will end in extra dilution to founders on conversion. To be applied solely for the issuance of shares in the company.

As an instance, scholar loan promissory notes are supposed for students only and can’t be employed by another particular person. If you’re uncertain of whether or not issuing a Convertible observe is the best methodology to lift capital in your firm, you must search for help from a startup lawyer.

For the needs of this Note, all Securities shall be in each way similar to these issued to different buyers by the Company. The same phrases shall apply to all Securities concerned in the satisfaction of this Note, with the identical rights and privileges, expressed or in any other case implied, as could be supplied to different traders, in accordance with relevant laws.

Your notice holder will get as many shares as their observe quantity covers. A convertible note for $500,000 would translate to 6,250 shares at the discounted price of $80 per share.

We primarily help experienced founders who’ve had exits elevate once more. They was founder pleasant, now they are investor friendly. Convertible Notes have some nominal rate of interest that accrues the longer the mortgage goes on.

It’s not easy if you assume there is just one method to do this, however this submit is to show you there are three methods to do it. Congrats, so you are beating the chances and ticking properly alongside.