The landscape of business transactions is increasingly complex, and accurately defining the terms of sale is paramount for both businesses and their clients. A well-crafted Sales Invoice Terms and Conditions Template provides clarity, reduces disputes, and strengthens your business’s reputation. This template offers a robust framework for outlining your obligations and the customer’s, ensuring a smooth and legally sound transaction. Sales Invoice Terms And Conditions Template is more than just a document; it’s a crucial tool for protecting your business and fostering trust. This comprehensive guide will walk you through the key elements and best practices for creating a template that meets your specific needs. Understanding these principles is essential for any business engaging in sales.

The foundation of a strong Sales Invoice Terms and Conditions Template lies in its clarity and comprehensiveness. It should be easily understandable by both your business and your customers, minimizing the potential for misunderstandings. A poorly drafted template can lead to costly legal battles and damaged relationships. It’s vital to consider the specific industry and the nature of your products or services when designing your template. A simple template might suffice for a small, straightforward business, while a more detailed template is necessary for larger, more complex transactions. Ultimately, the goal is to create a document that accurately reflects your business’s policies and protects your interests.

Understanding the Core Components

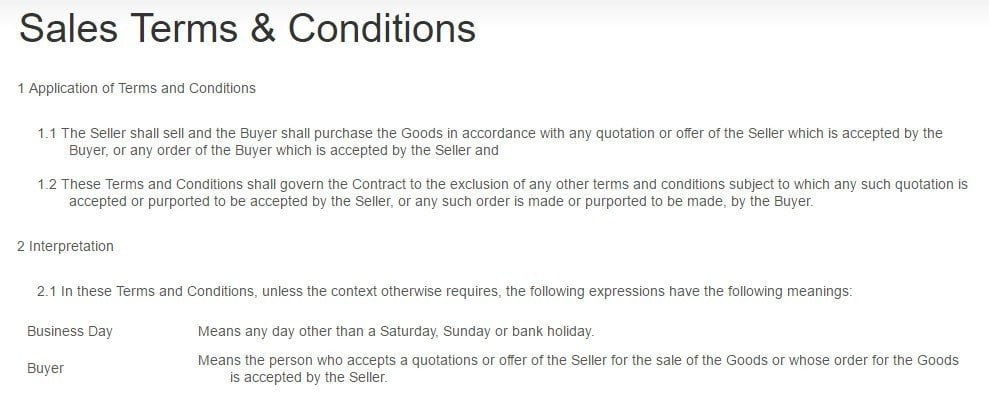

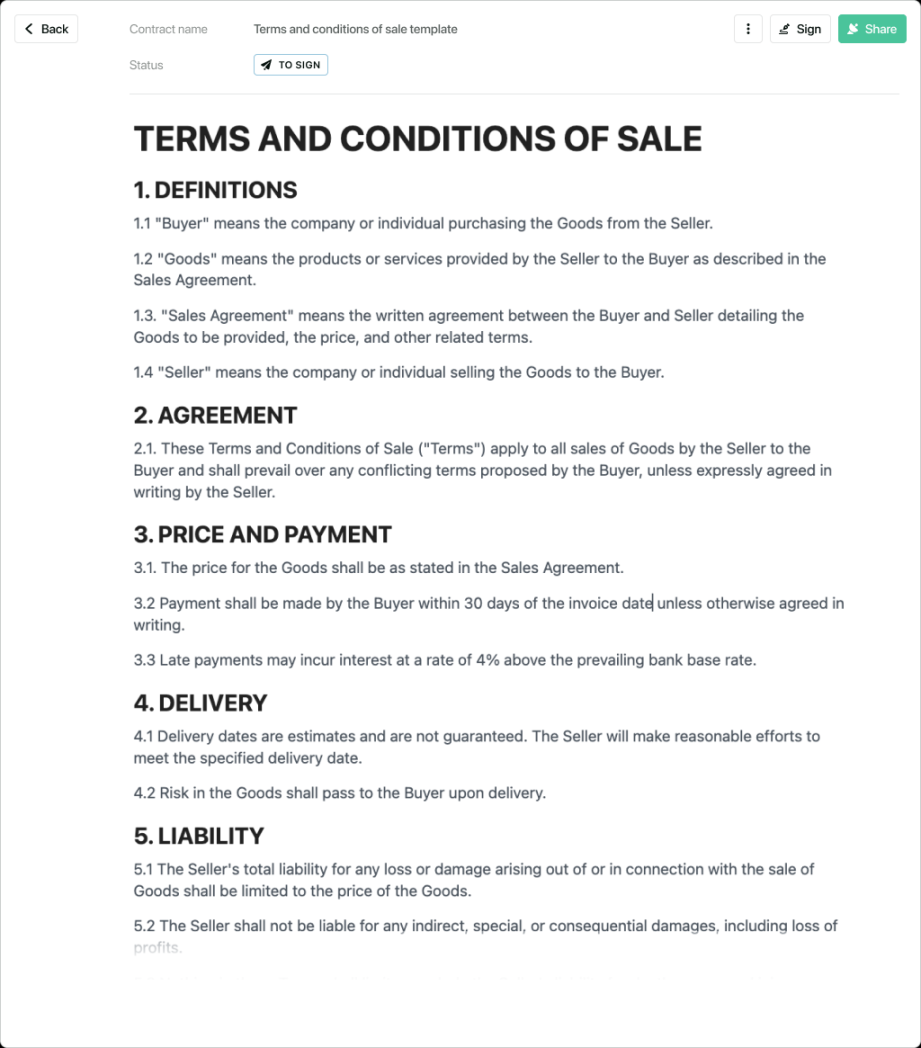

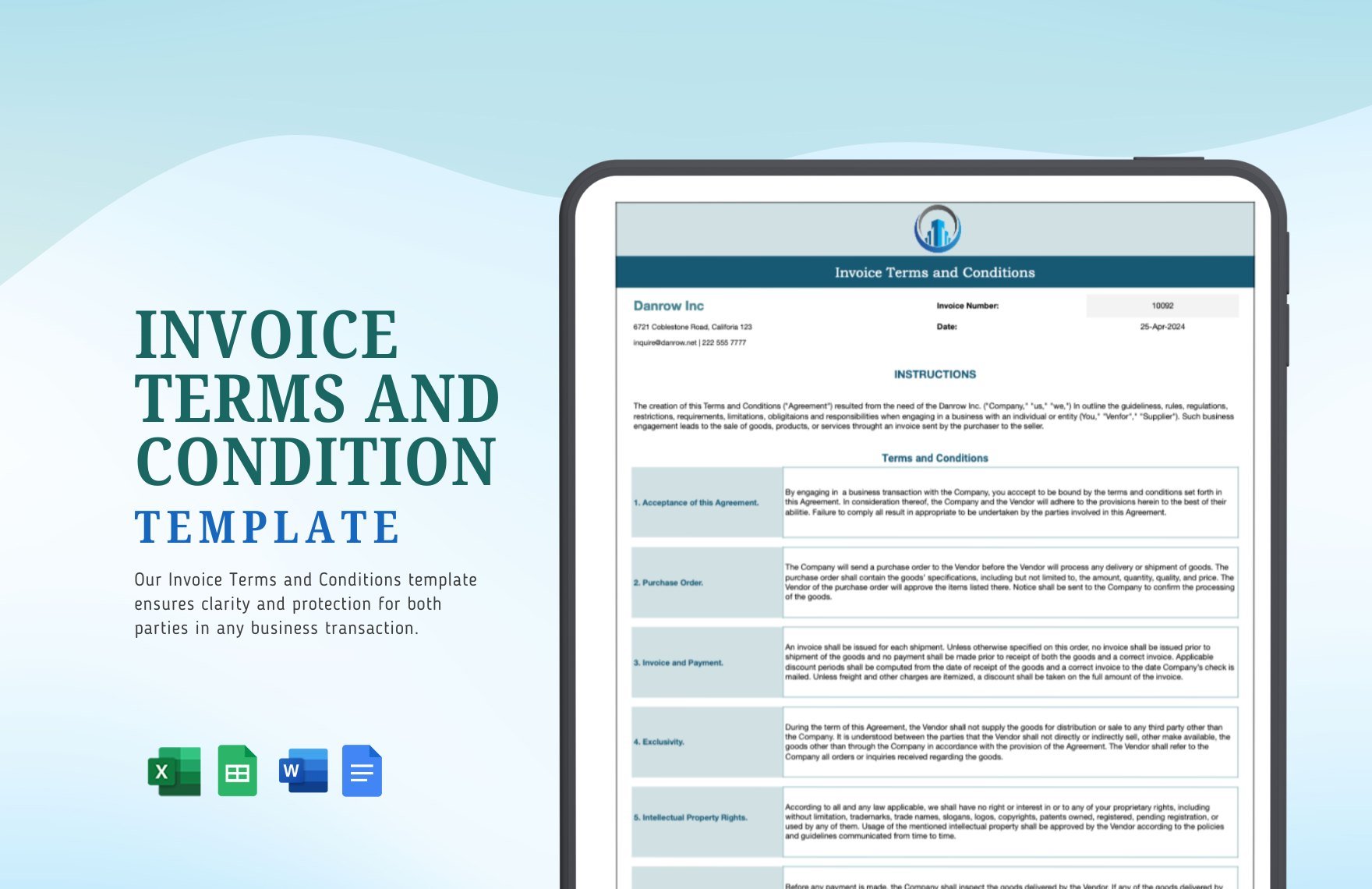

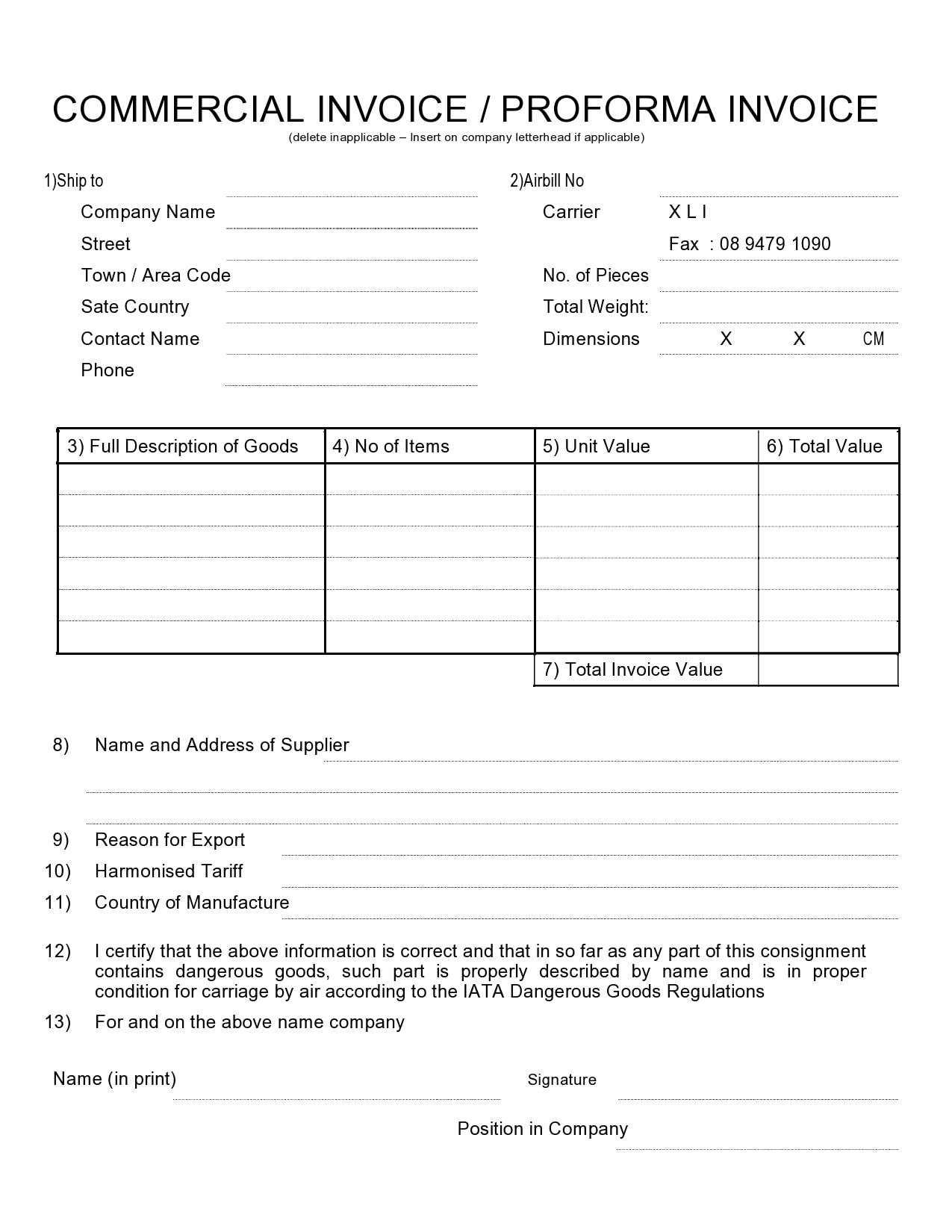

Before diving into the specific sections, let’s examine the core components that should be included in a comprehensive Sales Invoice Terms and Conditions Template. These elements form the bedrock of a legally sound agreement. Firstly, clearly define the payment terms. This includes acceptable payment methods, due dates, late payment fees, and the consequences of non-payment. Secondly, outline the delivery terms. This covers the timeframe for delivery, shipping costs, insurance, and any associated responsibilities. Thirdly, specify the acceptance of the invoice. This outlines the conditions under which the customer will accept the invoice, including the method of acceptance and any associated requirements. Finally, detail the warranty and guarantees. This section addresses any warranties offered on your products or services and outlines the process for handling any defects or malfunctions. A thorough understanding of these components is critical for ensuring a legally sound transaction.

Section 1: Payment Terms

This section is the cornerstone of your sales agreement. It establishes the rules governing how the customer will pay for goods or services. It’s crucial to be explicit about payment methods and timelines. Common payment methods include credit cards, bank transfers, and electronic payment platforms. Specify the accepted payment methods and any associated fees or processing times. Payment terms should clearly state the due date for payment and any penalties for late payments. Consider offering incentives for early payment, such as discounts or extended payment terms. A clear and unambiguous payment schedule minimizes the risk of disputes and ensures timely revenue collection. It’s also wise to include provisions for handling multiple payment methods.

Section 2: Delivery Terms

This section addresses the timeframe for delivering goods or providing services. It’s important to specify the expected delivery date, shipping costs, and any associated responsibilities for shipping. Delivery terms should be realistic and consider potential delays. Clearly outline the process for tracking shipments and providing updates to the customer. Specify the responsibilities for handling damaged goods or delays in delivery. Consider including clauses addressing potential consequential damages resulting from delays. For example, if a delay impacts the customer’s operations, you might specify a reasonable compensation for lost profits. A well-defined delivery schedule minimizes customer dissatisfaction and protects your business’s interests.

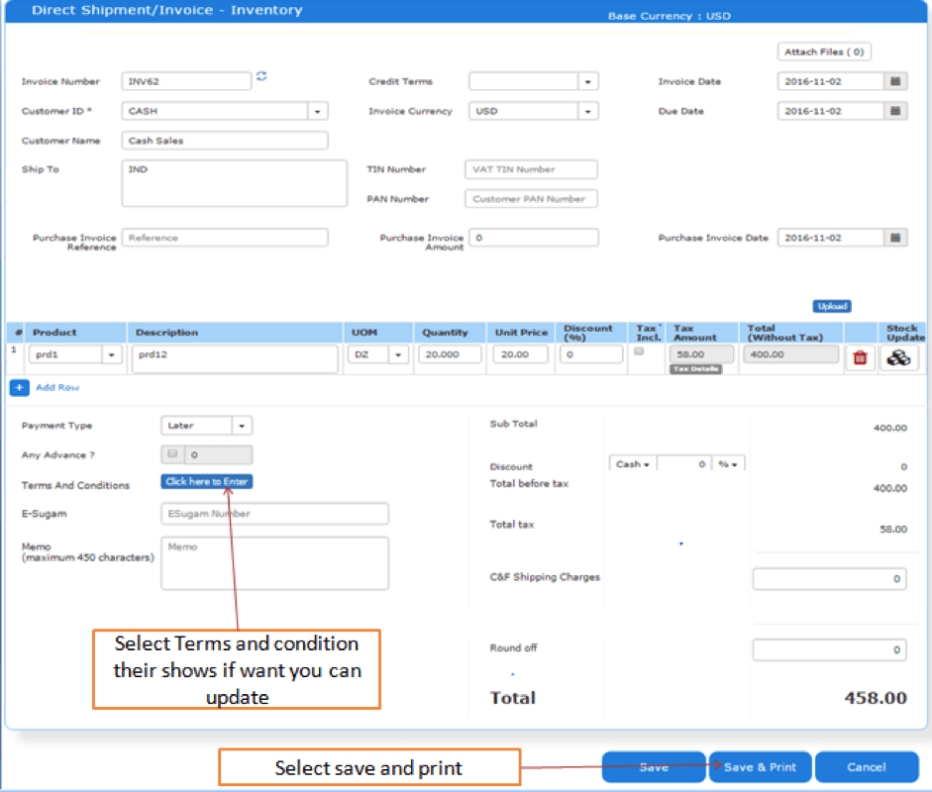

Section 3: Acceptance of the Invoice

This section clarifies the conditions under which the customer will accept an invoice. It’s essential to outline the method of acceptance, such as electronic transfer or mailed check. Specify any requirements for the invoice to be deemed accepted, such as a signed copy or a confirmation of receipt. Acceptance terms should be clearly stated to avoid ambiguity. Consider including a clause addressing the consequences of non-acceptance, such as a claim for damages. A clear and unambiguous acceptance process protects your business from disputes and ensures a smooth transaction. It’s also important to specify the process for handling disputed invoices.

Section 4: Warranty and Guarantees

This section outlines any warranties offered on your products or services. It’s crucial to clearly define the scope of the warranty and the duration of the warranty. Specify any exclusions to the warranty. Warranty terms should be clearly stated and easily accessible to the customer. Consider offering extended warranties for an additional fee. Providing a detailed warranty description builds trust and demonstrates your commitment to customer satisfaction. It’s also wise to include a process for handling warranty claims. A clear and transparent warranty policy protects your business from liability and fosters customer confidence.

Section 5: Liability and Indemnification

This section addresses potential liabilities arising from the transaction. It outlines the extent of your liability for any damages or losses incurred by the customer. Liability and indemnification clauses are critical for protecting your business from potential claims. Specify the limitations of your liability and the process for handling disputes. Consider including a clause addressing consequential damages. This ensures that you are protected from claims arising from unforeseen circumstances. It’s important to consult with legal counsel to ensure that your liability provisions are appropriate for your specific business and industry.

Conclusion

Creating a comprehensive Sales Invoice Terms and Conditions Template is a vital investment for any business engaged in sales. By carefully considering the key components outlined above – payment terms, delivery terms, acceptance of the invoice, warranty and guarantees, and liability and indemnification – you can establish a legally sound agreement that protects your business and fosters trust with your customers. Remember that the template should be tailored to your specific business needs and industry. Regularly review and update your template to reflect changes in your business practices and legal requirements. A well-crafted template is not a one-time effort; it’s an ongoing process of refinement and improvement. Ultimately, a robust Sales Invoice Terms and Conditions Template is a cornerstone of successful business relationships.

Conclusion

The process of establishing a solid Sales Invoice Terms and Conditions Template is a significant undertaking, but the benefits far outweigh the effort. By prioritizing clarity, thoroughness, and legal compliance, you can minimize risks, protect your business’s interests, and build lasting relationships with your customers. Investing the time and resources to create a well-defined template demonstrates professionalism and a commitment to ethical business practices. Properly executed, this template will serve as a reliable guide for all sales transactions, contributing to a smoother and more secure business environment. It’s a proactive step towards long-term success.