The process of securing a loan can be complex, filled with legal jargon and intricate requirements. A well-structured Loan Agreement Template is absolutely crucial for any lender or borrower seeking financing. This template provides a solid foundation for a legally sound agreement, minimizing risks and ensuring clarity throughout the process. It’s more than just a document; it’s a roadmap to a successful loan transaction. Lma Loan Agreement Template is designed to be adaptable, allowing for customization to suit specific loan terms and circumstances. This comprehensive guide will walk you through the key components and considerations involved in creating a robust and legally sound Loan Agreement Template. Understanding these elements is paramount for protecting both parties involved.

The foundation of any successful loan agreement rests upon a clear and comprehensive understanding of the borrower’s obligations and the lender’s rights. A poorly drafted agreement can lead to disputes, delays, and even legal action. Therefore, investing time and effort in creating a professional and legally sound Template is a wise investment. It’s a proactive step that safeguards your interests and promotes a smooth and efficient loan process. Consider this template as a starting point – tailoring it to your specific needs is essential.

Understanding the Core Components of a Loan Agreement Template

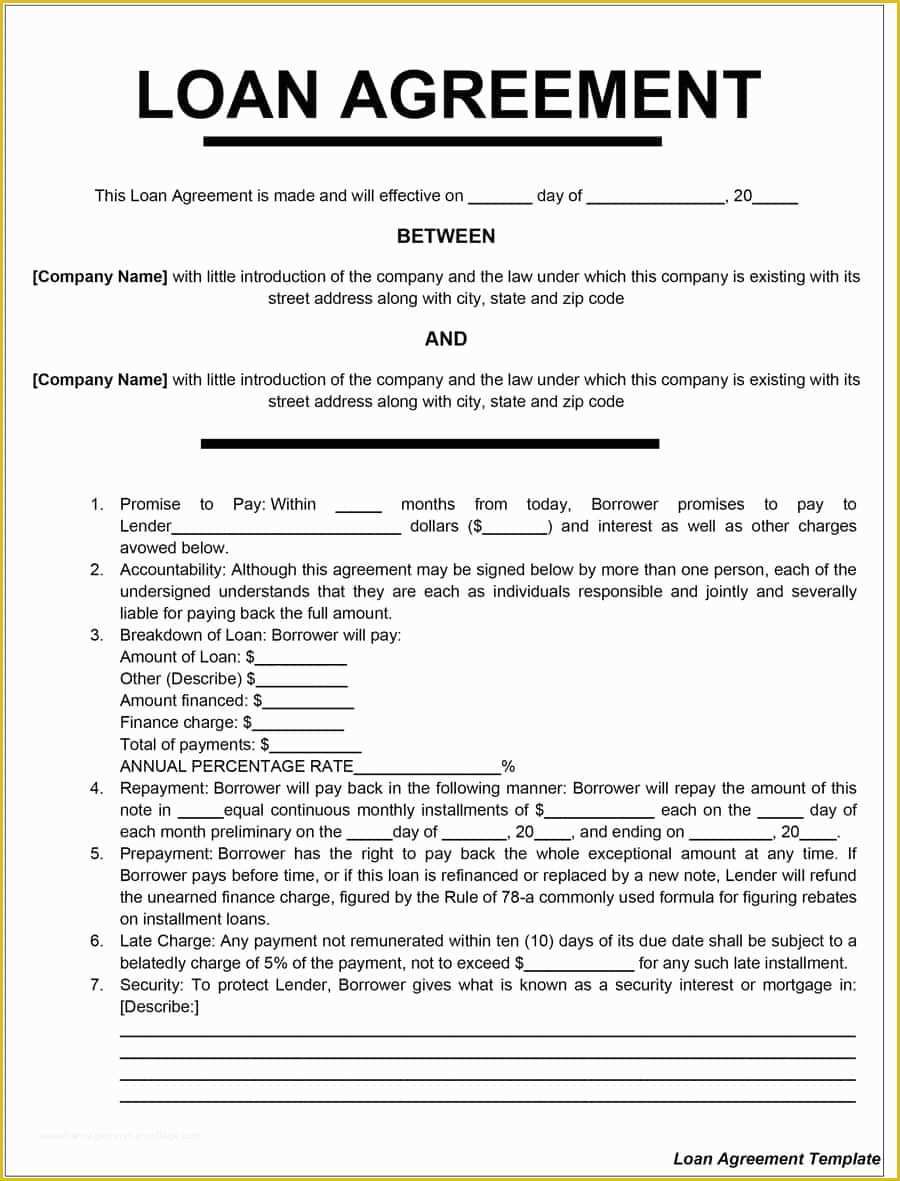

A comprehensive Loan Agreement Template typically includes several key sections. Let’s break down the most important elements:

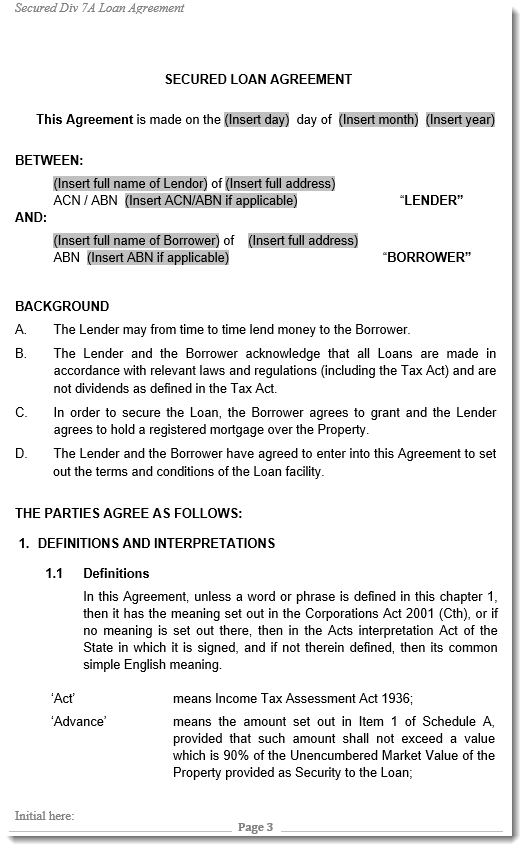

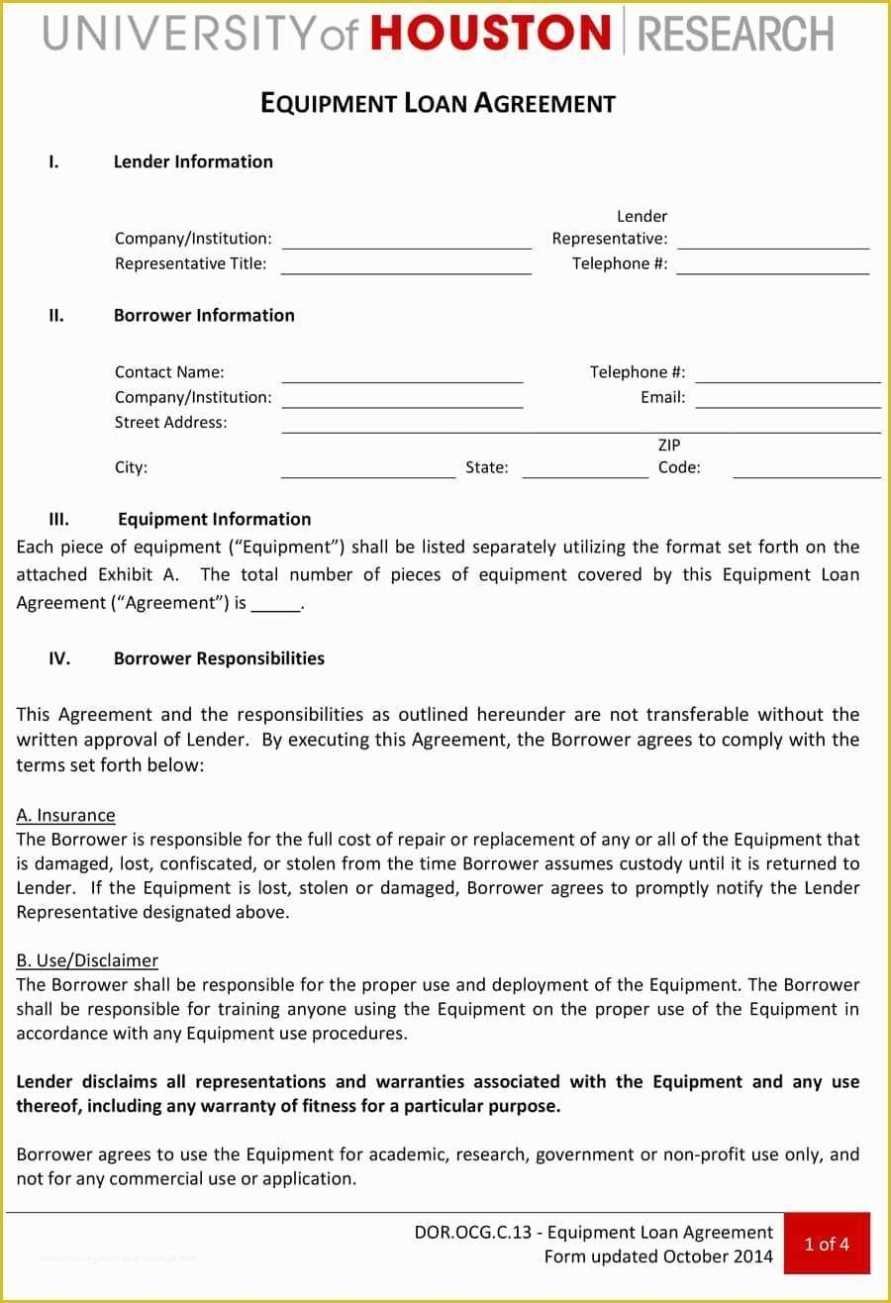

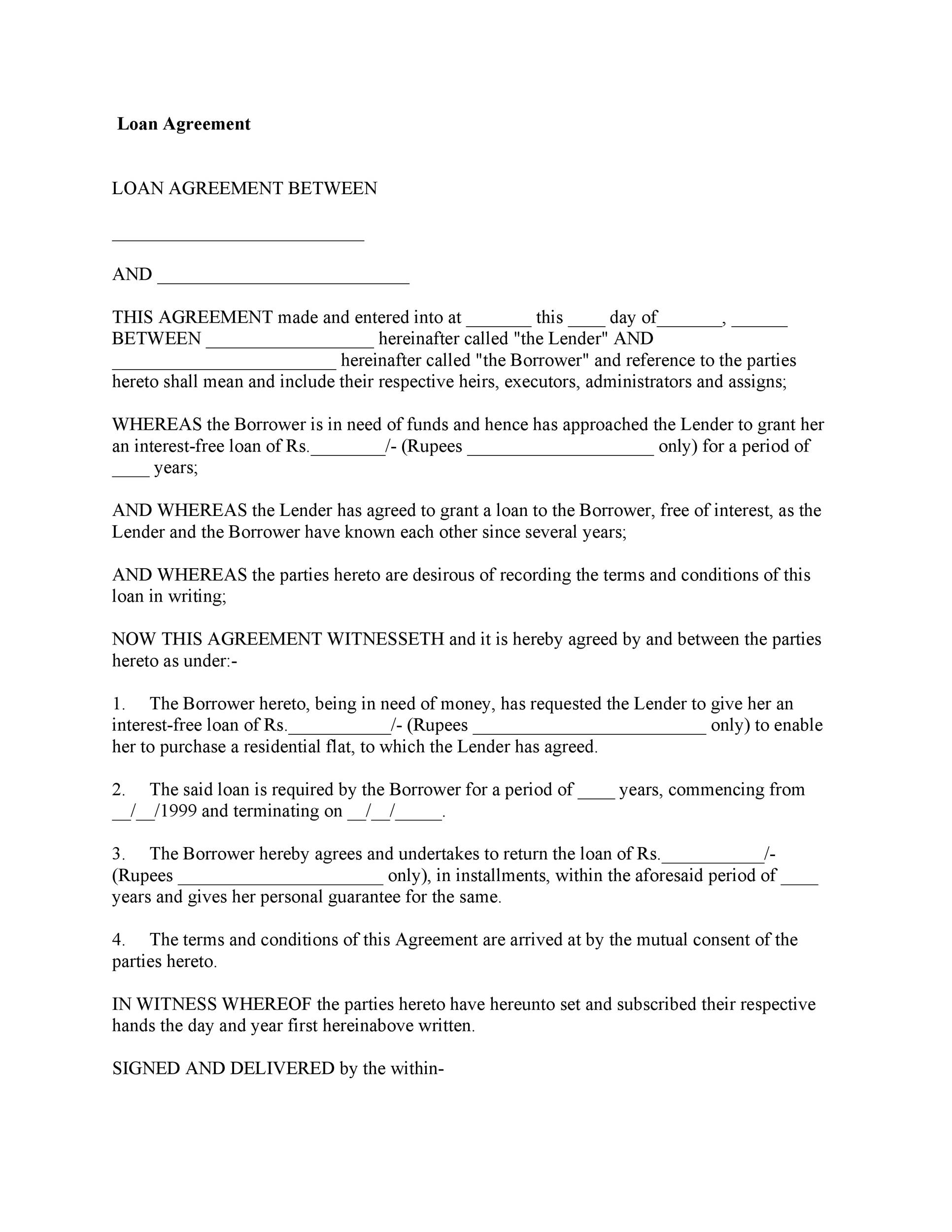

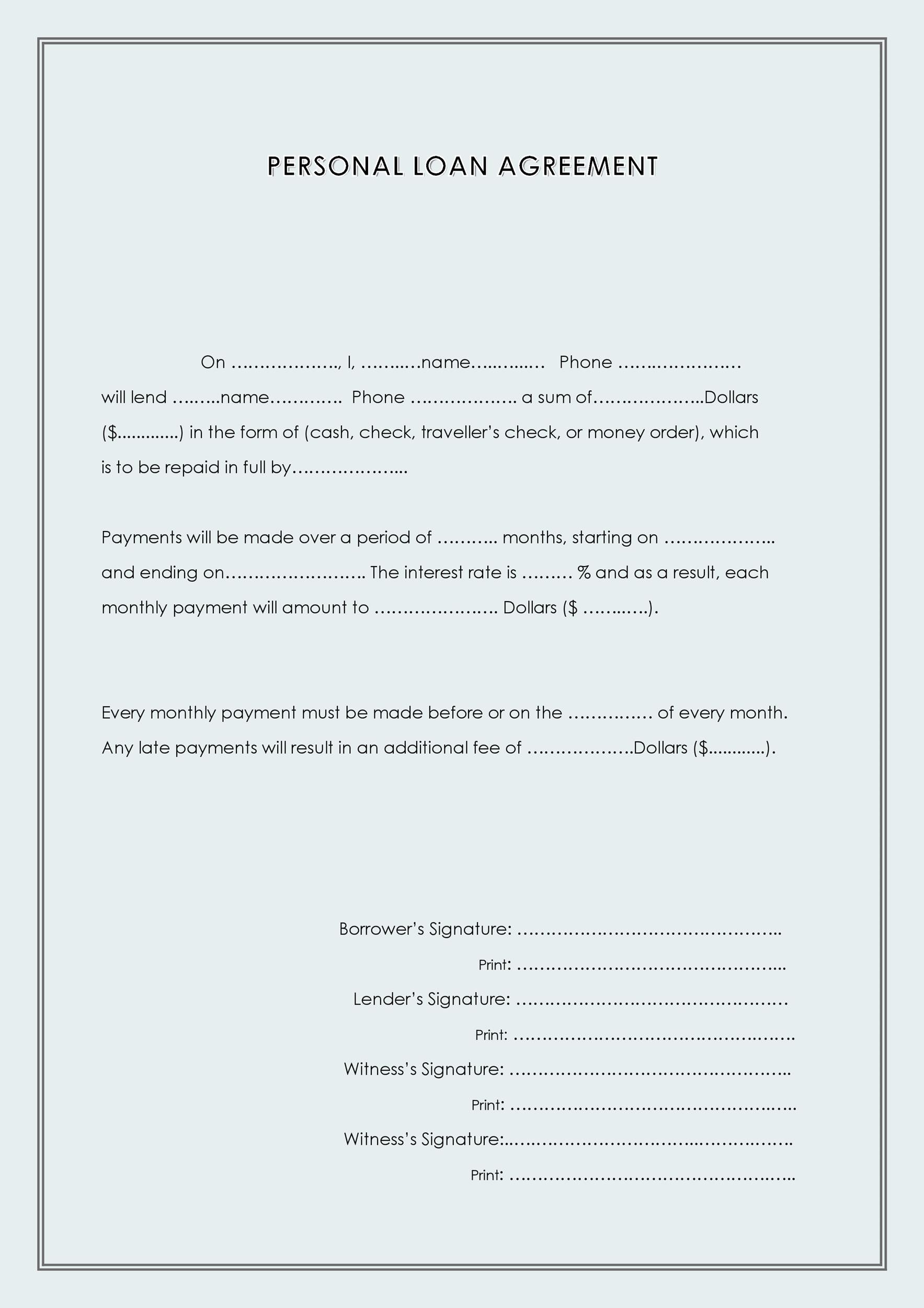

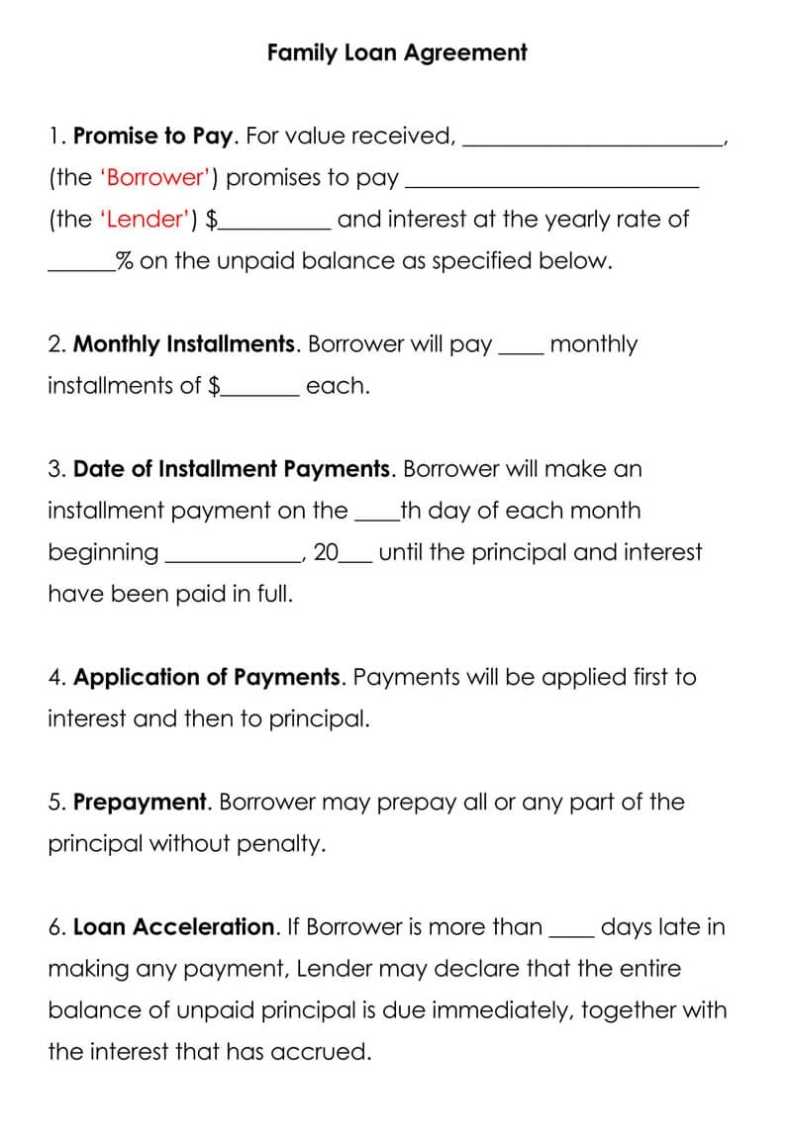

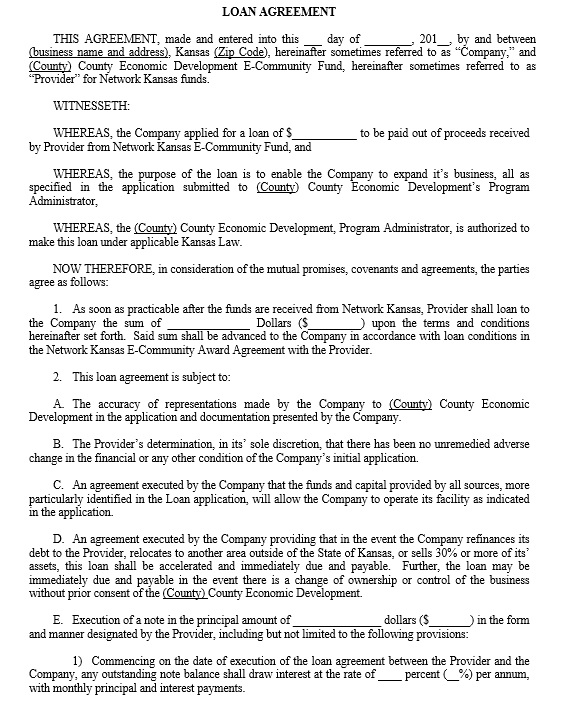

- Parties Involved: This section clearly identifies the borrower and the lender, including their full legal names and addresses. It’s vital to accurately represent each party’s identity to avoid future disputes. The lender’s legal designation (e.g., “ABC Financial Corporation”) should also be included.

- Loan Purpose: A detailed description of the loan’s intended use is critical. The lender needs to understand the borrower’s business plan and how the funds will be utilized. This section should be specific and unambiguous. For example, instead of simply stating “to expand operations,” specify “to purchase new equipment for manufacturing.”

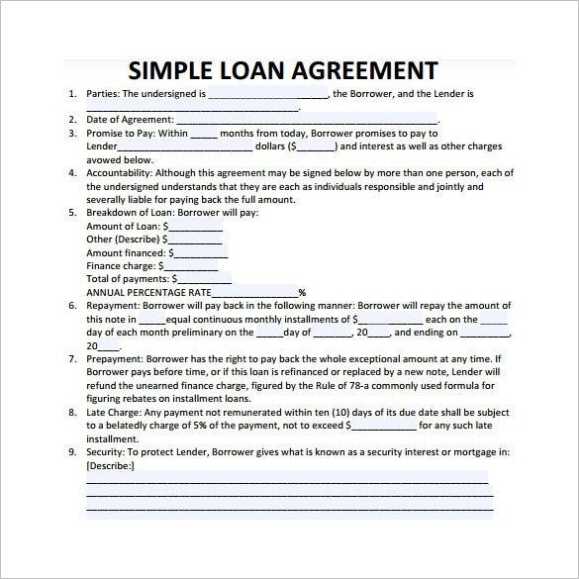

- Loan Amount & Terms: This section outlines the exact amount of the loan, the interest rate (fixed or variable), repayment schedule, and any collateral offered. Clearly defining these terms prevents misunderstandings and ensures transparency. The loan term (e.g., 5 years, 10 years) should also be specified.

- Repayment Schedule: The agreement should detail exactly how and when the borrower will repay the loan. This includes the payment frequency (e.g., monthly, quarterly), the payment amount, and any grace periods. A clear schedule minimizes risk for both parties.

- Collateral: If collateral is offered, this section describes the assets pledged as security for the loan. The valuation of the collateral is also outlined, ensuring a fair and accurate assessment.

- Default & Remedies: This section defines what constitutes a default by the borrower and outlines the lender’s remedies in the event of a default. This includes the possibility of acceleration (immediate repayment) and legal action.

- Governing Law & Dispute Resolution: Specifies the jurisdiction whose laws will govern the agreement and outlines the process for resolving any disputes that may arise. This could include mediation, arbitration, or litigation.

Section-by-Section Breakdown of Key Template Elements

Let’s examine some of the most important sections within a typical Loan Agreement Template:

1. Definitions: This section clarifies the meaning of key terms used throughout the agreement. It prevents ambiguity and ensures everyone understands the same language. For instance, “Loan,” “Principal,” and “Interest Rate” should be clearly defined.

2. Interest Rate & Fees: This section details the interest rate structure, including whether it’s fixed or variable, and any associated fees. Transparency in these areas is crucial for maintaining a fair and equitable agreement.

3. Security & Collateral: If collateral is involved, this section outlines the specific assets pledged and their value. A detailed appraisal may be required.

4. Compliance with Laws: This section confirms that the loan complies with all applicable federal, state, and local laws and regulations. It’s important to ensure the agreement is legally sound and protects the lender’s interests.

5. Amendments & Modifications: This section outlines the process for amending or modifying the Loan Agreement. It’s essential to establish a clear procedure for handling changes to the agreement.

The Importance of Professional Legal Review

While this template provides a framework, it’s absolutely essential to have a qualified attorney review the Loan Agreement Template before signing. A lawyer can ensure the agreement is tailored to your specific needs, complies with all applicable laws, and protects your interests. Errors or omissions in the agreement can have significant legal consequences. Furthermore, a lawyer can advise on the best course of action in the event of a dispute. Don’t attempt to navigate this process without professional guidance.

Beyond the Basics: Advanced Considerations

In addition to the core components, several advanced considerations should be addressed within a comprehensive Loan Agreement Template:

- Indemnification Clauses: These clauses protect the lender from liability for certain types of losses or damages arising from the borrower’s actions.

- Representations & Warranties: These clauses outline the borrower’s promises and assurances regarding the accuracy of information provided.

- Force Majeure: This clause addresses unforeseen events (e.g., natural disasters, war) that may impact the borrower’s ability to meet their obligations.

- Governing Law & Venue: Specify the jurisdiction whose laws will govern the agreement and where any legal disputes will be resolved.

Conclusion

Creating a robust and legally sound Loan Agreement Template is a critical step in securing a successful loan. By carefully considering the key components, understanding the importance of professional legal review, and incorporating advanced considerations, you can protect your interests and foster a positive and productive relationship with your lender. Remember, a well-crafted Agreement is an investment in your financial future. Investing the time and resources to create a solid Template will ultimately lead to a smoother and more profitable loan transaction. Lma Loan Agreement Template is a starting point, but adaptation and expert legal counsel are paramount for achieving a successful outcome.